Update: September 2019

I have converted my “Tax Cuts and Jobs Act” Blog post into a 100-page 6″x9″ book, that published on Amazon in September 2019. See the Amazon link below.

TAXES are EASY – The “Tax Cuts & Jobs Act”, TCJA, an Introduction. 2018 Tax Law and Forms

I plan no further updates to this Blog, as I am incorporating all the knowledge in the three years of Blog posts, into further books to be published on Amazon in 2020 and beyond.

The “Tax Cuts and Jobs Act” (TCJA) passed by Congress and signed by President Trump on December 22nd, 2017, made some major changes that will affect the upcoming 2018 tax year. Some (41) topics of change that will affect Individual Tax returns are summarized below – as sorted by the (8) main topic Sections shown in red lettering.

Continue to scroll down through the Blog post to then review the detailed explanations of the (41) topics. Each topic is described in an outline format with more in depth explanations illuminating many topics.

Throughout the Blog you will notice (33) blue underlined hyperlinks to articles, websites and IRS tax forms – linked to research references for some of the explanations. Just click any of the hyperlinks to open a new browser window to read the references. For instance, there is a link to my Blog post that explains the new 2018 single-page IRS form 1040. Other links reference tax articles that support the topic explanations.

The purpose of this Blog post is to give you a thorough “first introduction” to the upcoming changes that will affect the 2018 Individual Tax return – that you are required to file by the April 15th, 2019 tax deadline. Business tax issues of large companies affected by the TCJA legislation are not covered in this Blog post.

The Blog post was written primarily for the Individual Taxpayer but also contains sufficient detail to be useful to any Tax Professional as a thorough overview of the 2018 TCJA changes to Individual taxes.

The Blog post is by no means an exhaustive explanation of every minute detail of the TCJA. That would be a book consisting of several hundred pages of explanations. Reading and studying this Blog post should serve as the start of your 2018 Individual income tax review.

The updated 2018 tax software you might use to self-prepare your own tax return, or the advice and tax preparation services from your own tax professional you would hire, and your own further education – should be utilized to continue the understanding of your own, unique 2018 “Tax Story” – and how the TCJA changes will affect your upcoming 2018 Individual form 1040 tax return.

This is the Summary of the (41) Topics to be discussed in detail – further down the Blog post

SECTION #1 ( topics #1 – #3 summarized )

- The new single-page IRS 1040 form & changes to the Income Tax Brackets and Capital Gains Tax Brackets

- The previously used IRS Individual tax forms 1040EZ, 1040A and the 2-page 1040 have been eliminated

- They have been replaced with a new single-page 1040 form that uses (6) new supporting schedules

- You can click the link to my Blog post – that explains the new 1040 form and its supporting schedules

- The 2018 tax year Income Tax Brackets now use lowered tax rates and higher associated income levels

- The 2018 Capital Gain and Qualified Dividend Tax Brackets are now calculated differently.

- The 0%/15%/20% Capital Gain Tax Rate levels are now based on your filing status and income levels

- The previously used IRS Individual tax forms 1040EZ, 1040A and the 2-page 1040 have been eliminated

SECTION #2 ( topics #4 – #6 summarized )

- Personal Exemption and Dependent Credit changes

- The Personal Exemption deductions previously listed on the tax return for the Taxpayer, the Spouse, any Qualifying Child and any Qualifying Relative – have been eliminated from the new 2018 form 1040

- The legislation set the Personal Exemption amount to zero after Dec. 31st, ’17 and before Jan. 1st, ’26

- The Child Tax Credit has doubled to $2,000 per eligible Qualifying Child from the previous $1,000

- with the refundable component of the Child Tax Credit – called the Additional Child Tax Credit – being increased to $1,400 from the previous $1,000

- The income levels under which you can claim the Child Tax Credit have increased substantially such that many more taxpayers will benefit from the credit

- up to $400,000 for a Married Filing Jointly couple

- up to $200,000 for all other filing statuses

- A new nonrefundable $500 “Credit for Other Dependents” is available for any Qualifying Child and/or Qualifying Relative listed on the tax return who would not be eligible for the Child Tax Credit.

- The Personal Exemption deductions previously listed on the tax return for the Taxpayer, the Spouse, any Qualifying Child and any Qualifying Relative – have been eliminated from the new 2018 form 1040

SECTION #3 ( topics #7 – #19 summarized )

- Standard Deduction and Itemized Deduction changes

- The 2018 tax year Standard Deductions have almost doubled from the 2017 levels

- The phase-out of the Itemized Deductions has been eliminated for higher-income taxpayers

- Fewer Taxpayers will Itemize their Deductions as the Doubled Standard Deduction will be a better value

- Meaning the taxpayer would get a larger deduction from their Adjusted Gross Income (AGI) using the higher Standard Deduction – as compared to any Itemized Deduction totals they could have used.

- Miscellaneous Deductions subject to the 2% of AGI threshold are “suspended” until Jan. 1st, 2026

- The 7.5% of AGI threshold for deducting Medical Expenses as an Itemized Deduction remains for 2018

- There is now a $10,000 per tax return limit on deducting the aggregate total of the SALT deductions

- SALT stands for the State And Local Tax deduction

- There is a lower Mortgage Interest Deduction limit on new primary and secondary home mortgages

- Interest on a Home Equity Loan is no longer deductible unless used to improve your residence

- Mortgage Insurance Premiums are no longer deductible as an Itemized Deduction

- Due to the Standard Deductions being doubled fewer Taxpayers will deduct Charitable Contributions

- You have to qualify for the Itemized Deductions to benefit from a Charitable Contribution deduction

- Charitable Contribution rule changes

- Taxpayers can no longer deduct non-disaster Casualty and Theft Losses as an Itemized Deduction

- Deductions for living expenses of Members of Congress while away from home eliminated

- They previously were allowed to deduct $3,000 as an Itemized Deduction

SECTION #4 ( topics #20 – #27 summarized )

- Expired, Suspended, Eliminated or Modified Adjustments and Deductions

- You can no longer deduct ordinary Moving Expenses related to moving to a new city for a new job

- Unless you are an active duty military personnel and moved to a new duty station

- Qualified Bicycle Commuting Reimbursement Exclusion has been suspended until Jan. 1st, 2026

- The Tuition & Fees deduction as an Adjustment to Income was not extended for any tax year after 2017

- The Mortgage Debt Exclusion was not extended for any tax year after 2017

- The Credit for Nonbusiness Energy Property was not extended for any tax year after 2017

- Alimony is no longer deducted as an Adjustment to Income for the payer, and no longer taxable as Ordinary Income to the recipient – for new divorce or separation agreements after Dec. 31st, 2018.

- Discharge of Student Loan Debt Exclusion item added for the death or disability of the former student

- Professional Gamblers can now use both losses and non-wagering gambling expenses to offset their legal Professional Gambling winnings – down to zero.

- They cannot use net gambling losses to offset any other Ordinary Income listed on the tax return

- You can no longer deduct ordinary Moving Expenses related to moving to a new city for a new job

SECTION #5 ( topics #28 – #30 summarized )

- Changes to Tax Advantaged Savings Accounts for Education/Disabled Individuals & Backdoor Roth IRAs

- Distributions from 529 Qualified Tuition Program plans now allowed for Kindergarten thru High School

- This new rule does not apply to any Home Schooling expenses

- ABLE account contribution limits have been expanded for the disabled Beneficiary

- Roth IRA Recharacterization Rules clarified and the so-called Backdoor Roth IRA explained

- Distributions from 529 Qualified Tuition Program plans now allowed for Kindergarten thru High School

SECTION #6 ( topics #31 – #32 summarized )

- The Affordable Care Act changes

- Penalty still in effect for not having Qualified Health Insurance for all 12-months of the 2018 tax year

- The penalty is then reduced to zero for tax years 2019 and beyond

- The Premium Tax Credit and Advanced Premium Tax Credit are still available to lower income taxpayers to subsidize – or help pay for – their monthly health insurance premiums for qualified health insurance policies purchased on the Marketplace Health Insurance Exchanges.

- The (2) Affordable Care Act taxes have been retained – for high-earner’s investment and salary income

- Penalty still in effect for not having Qualified Health Insurance for all 12-months of the 2018 tax year

SECTION #7 ( topics #33 – #36 summarized )

- High-Earner Income changes

- The AMT (Alternative Minimum Tax) exemption amounts have increased significantly such that far fewer taxpayers will be subject to any AMT tax obligation

- The so-called Kiddie Tax was revised to no longer use the Parent’s income tax rate for unearned income

- Deferral of income reporting allowed for up to five years for certain Private Company Stock Option Plans

- An eligible Employee of the Private Company can defer the income by using the Section 83(i) Election

- Estate and Gift Tax Exemptions doubled and the Gift Tax Exclusion Amount increased to $15,000/year

SECTION #8 ( topics #37 – #41 summarized )

- Self-Employment and Small Business changes

- 20% Qualified Business Income (QBI) deduction for Self-Employed & Pass-Through Business entities

- More generous Depreciation rules for Self-Employed and Pass-Through Business entities

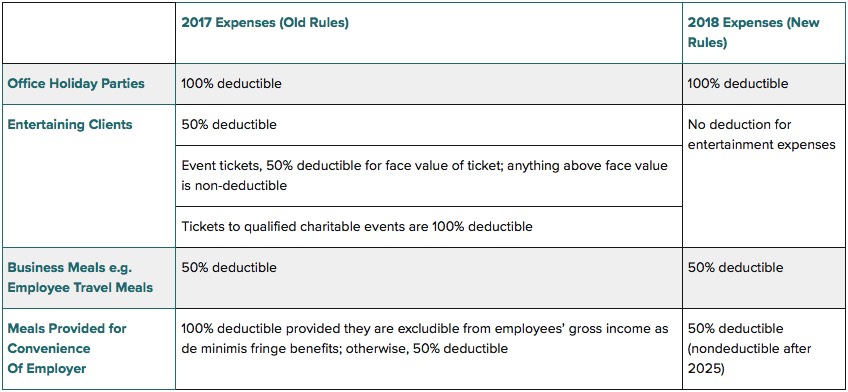

- Meals & Entertainment deduction changes, most notably that businesses can no longer deduct Entertainment expenses incurred with their customers or clients at a business-related event

- 2018 tax year Like-Kind exchanges now limited to Real Property (Real Estate) only. Personal Property Like-Kind exchanges no longer allowed in tax years 2018 and beyond.

- Supplemental wages were taxed at a flat 25% tax rate in 2017 and will be taxed at a flat rate of 22% in 2018 and beyond, provided the bonus is under $1 million

SECTION #1 ( topics #1 – #3 explained in detail )

New single-page IRS 1040 form & changes to the Income Tax Brackets and Capital Gains Tax Brackets

- The previously used IRS Individual tax forms 1040EZ, 1040A and the 2-page 1040 have been eliminated

- They are being replaced by the new single-page 1040 form and (6) new supporting Schedules

- See my Blog post at What Tax Form Should I Use? (2018 tax year) for an explanation of the new single-page 1040 form and the (6) new supporting Schedules.

- Click once on the blue underlined Hyperlink – to see the Blog post open in a new browser window

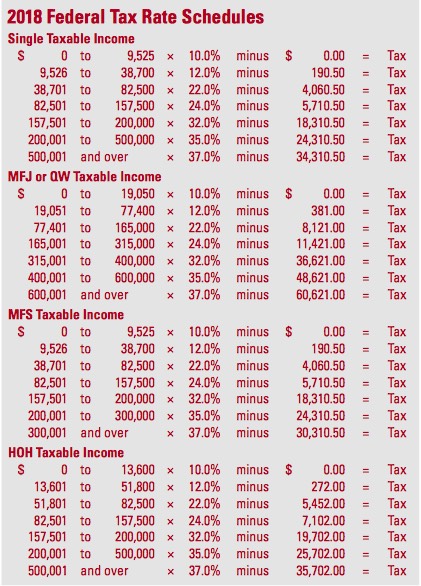

- The 2018 tax year Income Tax Brackets have changed, to reflect the slightly lower income tax rate brackets and the slightly increased income thresholds for each tax rate bracket.

- See the tables below for 2018 & the older 2017. ©2018 The Tax Book

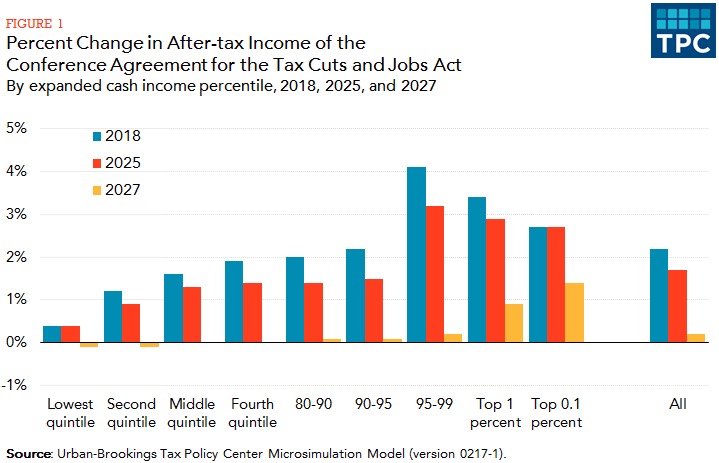

- This nonpartisan Tax Policy Center article gave these estimates of the tax savings for the US population:

- Those in the lowest-earning fifth would see their after-tax income increase by 0.4 percent

- Those in the next-highest fifth would receive a 1.2 percent boost in their after-tax income

- The next two quintiles would see their after-tax income increase 1.6 percent and 1.9 percent

- Taxpayers in the top-earning fifth will see an after-tax income increase of 2.9 percent

- See the graph table below that illustrates these estimates

- I included this chart as both sides of the political spectrum tend to argue about who will benefit, and who will not benefit, from the TCJA changes to the income tax brackets. As an Enrolled Agent, my job is to provide Taxpayers and my Clients the information they need to make informed decisions about their own Individual 2018 “Tax Story”. My job is not to offer opinions about the pros and cons of tax legislation.

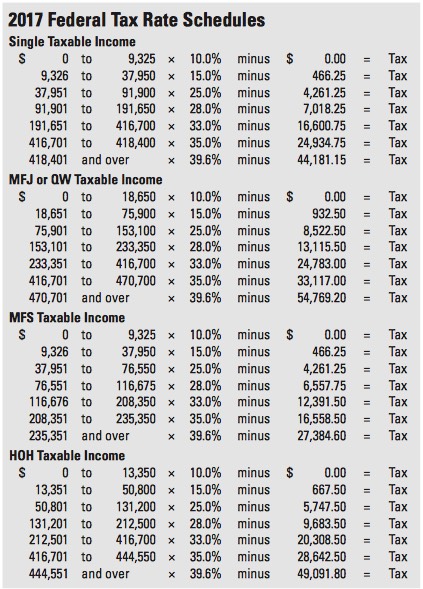

- The 2018 Capital Gain and Qualified Dividend Tax Brackets are calculated differently, as they no longer are based on the income tax brackets. They are now based on your Filing Status and Taxable Income level.

- See the table below. ©2018 The Tax Book

- For example a Single taxpayer would pay no tax on his or her Capital Gains on qualified investment income, if their Taxable Income level was between $0 to $38,600. They would pay a 15% capital gains tax rate if their Taxable Income was in the range between $38,601 to $425,800.

- Typically qualified investment income subject to the lower capital gain rates comes from selling mutual fund shares, or selling stocks – that were held for more than one year.

- Qualified Stock Dividends are also subject to and benefit from the lower capital gain rates.

SECTION 2 ( topics #4 – #6 explained in detail )

Personal Exemption and Dependent Credit changes

- The Personal Exemption deductions for the Taxpayer, the Spouse, any Qualifying Child and any Qualifying Relative – have been set to zero – after Dec. 31st, 2017 and before Jan. 1st, 2026

- Therefore Personal Exemptions have been removed from the new 1040 form until January 1st, 2026.

- All the rules for the previous Personal Exemption deductions remain in the IRS Tax Code, ready to be reactivated if and when the Congress would reinstate the Personal Exemption amount – to above zero.

- See the IRS Code Section at:

- 26 U.S. Code § 151 – Allowance of deductions for personal exemptions

- The Law School at Cornell University manages this Tax Code web site. It is a favorite web site for us “Tax Geeks” who read and study the actual text of the Tax Code. A Google search per tax code section works very well to then display the relevant Tax Code section being researched.

- The Personal Exemption deduction amount had been $4,050 per person listed on your tax return for the most recent 2017 tax year.

- This deduction was for the Taxpayer, the Spouse, each Qualifying Child and each Qualifying Relative.

- The now higher $2,000 Child Tax Credit and the new $500 “Credit for Other Dependents” – are designed to somewhat compensate for the elimination of the Personal Exemption deduction.

- The doubling of the Standard Deduction was also designed to help mitigate the loss of this deduction.

- The Child Tax Credit has doubled to $2,000 per eligible Qualifying Child listed on your tax return, with the refundable Additional Child Tax Credit component increased to $1,400 per eligible Qualifying Child.

- The credit is available for each Qualifying Child under age 17 on Dec. 31st, with a Social Security Number

- In previous tax years a Qualifying Child with an ITIN number (Individual Taxpayer Identification Number ) would be eligible for the Child Tax Credit. For the 2018 tax year and beyond each eligible Qualifying Child needs a Social Security Number to qualify the taxpayer for the Child Tax Credit.

- The Child Tax Credit can only reduce your tax obligation to zero, but not below zero.

- It is considered a nonrefundable credit.

- The Additional Child Tax Credit component can actually add to your refund even if your tax obligation has been reduced to zero. It is a refundable credit based on the amount of your yearly earned income.

- Each Qualifying Child must have a Social Security Number to be eligible for the refundable Additional Child Tax Credit

- The earned income threshold has decreased to $2,500 from the previous $3,000. This is used to calculate how much of that refundable $1,400 Additional Child Tax Credit you will qualify for.

- It calculates as 15% of your income over the $2,500 threshold up to the $1,400 per Qualifying Child

- Therefore a taxpayer with earned income of $11,833 or more is potentially eligible for the full $1,400 Additional Child Tax Credit. ($11,833 minus $2,500 = $9,333) so ($9,333 * 15% = $1,400 )

- The Child Tax Credit and the Additional Child Tax Credit component work in tandem.

- For Example let’s consider this scenario:

- Your son (age 9) and daughter (age 11) each are listed as a Qualifying Child on your tax return. They are both under the age of 17 on Dec. 31st, 2018. That would then qualify you for the $2,000 each for your son and daughter for the Child Tax Credit for a total of $4,000. That $4,000 could then be used to reduce your tax obligation to zero.

- Now let’s assume your initial tax obligation (line 11 of the new 1040 form) after the Standard Deduction is only $1,700. So you could only use $1,700 of your maximum $4,000 Child Tax Credit to reduce your tax obligation down to zero. That would leave $2,300 of unused Child Tax Credits, that you could possibly use – as a refund – if you qualify for the Additional Child Tax Credit..

- The Additional Child Tax Credit component then calculates if your earned income was high enough to qualify you to benefit from those $2,300 of unused Child Tax Credits to be applied as a tax refund.

- You can use up to $1,400 of unused credits per Qualifying Child for the Additional Child Tax Credit

- The amount of your earned income above $2,500 is multiplied by 15%. If the earned income value in this example was at least $17,833, then you could benefit from the $2,300 of unused credits.

- $17,833 minus $2,500 equals $15,333

- $15,333 times 15% equals $2,300

- You would then qualify for the full $2,300 of the refundable Additional Child Tax Credit.

- Your tax refund would then be increased by this $2,300 value.

- The income phase-out levels have increased substantially for the 2018 tax year such that many more families with children will qualify to receive the Child Tax Credit.

- The Credit begins to phase-out when the Married Filing Jointly couple’s income exceeds $400,000

- previously that phase-out level started at $110,000 for the Married Filing Jointly couple

- the credit will begin to phase-out by $50 for each $1,000 the income exceeds $400,000

- therefore the credit would not be allowed for incomes above the $440,000 level for 1-child

- an additional $40,000 of income phase-out is used for each additional child

- The Credit begins to phase-out for all other taxpayer filing status’s when income exceeds $200,000

- previously that phase-out level was $75,000 for the Single, Head of Household and Qualifying Widow(er) filing statuses and $55,000 for the Married Filing Separately filing status

- the credit will begin to phase-out by $50 for each $1,000 the income exceeds $200,000

- therefore the credit would not be allowed for incomes above the $240,000 level for 1- child

- an additional $40,000 of income phase-out is used for each additional child

- Refer to the links below for the IRS forms that perform all the Child Tax Credit calculations

- The credit is available for each Qualifying Child under age 17 on Dec. 31st, with a Social Security Number

- A new $500 “Credit for Other Dependents” for any Dependent listed on your tax return who would not be eligible for the Child Tax Credit

- A new nonrefundable “Credit for Other Dependents” of $500 is allowed for any Dependent listed on your tax return that is not an eligible Qualifying Child for the Child Tax Credit. A Dependent is defined as a Qualifying Child or Qualifying Relative that satisfies the eligibility requirements to be listed on your tax return.

- If your Qualifying Child is age 17 or older at the end of the year, they will not be eligible for the Child Tax Credit. They could, though, qualify for this new “Credit for Other Dependents”.

- This rule also applies to any Child who is “permanently and totally disabled” and age 17 or older at the end of the tax year. They are not eligible for the Child Tax Credit.

- The Gross Income test for a Qualifying Relative is $4,150 for the 2018 tax year. This means for a person to be listed as your Qualifying Relative, they cannot have taxable Gross Income above the $4,150.

- This $4,150 Gross Income test does not apply to a Qualifying Child. If your Qualifying Child earns money, they can still be listed as your Dependent providing they do not use the money they earned to pay for more than 50% of their support living in your household – referred to as their living expenses.

- This $500 “Credit for Other Dependents” can help reduce your tax obligation to zero, but not below zero, as it is not a refundable credit – like the refundable $1,400 per child component of the Additional Child Tax Credit.

- The income phase-out ranges for this “Credit for Other Dependents” have been confirmed by the IRS, to be the same as noted above for the Child Tax Credit.

- A Qualifying Child and/or Qualifying Relative who does not possess a valid Social Security Number can qualify for this “Credit for Other Dependents”

- They must have an ITIN number (Individual Taxpayer Identification Number ) for this credit.

- IRS Draft forms for the Child Tax Credit & Credit for Other Dependents and Additional Child Tax Credit

SECTION 3 ( topics #7 – #19 explained in detail )

Standard Deduction and Itemized Deduction changes

- The 2018 tax year Standard Deductions have almost doubled to:

- $12,000 for the Single and Married Filing Separately filing status

- add $1,600 if over the age of 65

- add $1,600 if blind

- $24,000 for the Married Filing Jointly and Qualifying Widow(er) filing status

- add $1,300 for each spouse or qualifying widow(er) over the age of 65

- add $1,300 for each blind spouse or blind qualifying widow(er)

- $18,000 for the Head of Household filing status

- add $1,600 if over the age of 65

- add $1,600 if blind

- $12,000 for the Single and Married Filing Separately filing status

- The phase-out of the Itemized Deductions has been eliminated for higher-income Taxpayers:

- In recent tax years the Itemized Deduction amounts were phased out for higher-income Taxpayers

- For example, a Single person with an Adjusted Gross Income over $261,500 in 2017, would have had their Itemized Deductions begun to be phased out, by up to 80% of their itemized deductions.

- The Itemized Deduction amount will no longer be phased out according to your higher income

- In recent tax years the Itemized Deduction amounts were phased out for higher-income Taxpayers

- Fewer Taxpayers will Itemize their Deductions as the Doubled Standard Deduction will be a better value

- In previous years around 30% of Taxpayers benefited by using the Itemized Deduction, according to the IRS published figures.

- With the new tax law changes, it is now estimated that only 10% of Taxpayers will Itemize, according to the nonpartisan Tax Policy Center.

- Fewer taxpayers will use the Itemized Deduction – in part because of these changes:

- The SALT (State and Local Tax) deduction is now limited to $10,000 per tax return

- The deduction for Mortgage Interest and Home Equity Loan Interest has decreased for new loans

- With the doubling of the Standard Deduction, fewer people will be able to take the deduction for Charitable Contributions – as their total Itemized Deductions will not be more than the new higher Standard Deduction value. Charitable Contributions are listed only as an Itemized Deduction.

- Personal Casualty and Theft Losses are no longer deductible, unless the casualty or theft event happened in a Federally Declared Disaster Area, as designated by the President

- The Miscellaneous itemized deductions subject to the 2% of AGI limit have been “suspended”

- This included unreimbursed job expenses and job-related education expenses

- This included any Home Office expenses you needed to incur for your remote salary job if your wages were reported to you on a W-2 form from your employer.

- This included travel and entertainment expenses you incurred as a salaried sales person if your wages were reported to you on a W-2 form from your employer.

- Salaried Taxpayers can no longer deduct job-related Unreimbursed Business and/or job-related Education Expenses. Other Taxpayers can no longer deduct the other 2% Miscellaneous Deductions.

- Miscellaneous Deductions subject to the 2% limitation have been “suspended” until January 1st, 2026.

- All Miscellaneous Itemized Deductions formerly allowed above 2% of your Adjusted Gross Income – have been eliminated from the 2018 Schedule A that lists Itemized Deductions. These would include:

- work-related travel, transportation, and mileage (including DOT per diem)

- work-related meals, entertainment, gifts and lodging

- union dues

- business liability insurance premiums

- depreciation on a computer or cellular telephone your employer requires you to use for your work or for personal investments you managed

- memberships in and dues to professional societies

- work-related education to improve your current job skills

- home office expenses for that part of your home you used regularly and exclusively for your work

- expenses of looking for a new job in your present occupation

- legal fees related to your job

- licenses and regulatory fees related to your job, such as for Lawyers, Doctors, etc.

- malpractice insurance related to your job

- subscriptions to professional journals and trade magazines related to your work

- tools and supplies used in your work

- work clothes and uniforms (if required and not suitable for everyday use)

- educator expenses in excess of $250

- investment advisory and management fees

- fees for legal and tax advice related to your investments

- appraisal fees for casualty losses or donations

- trustee fees to manage IRAs and other investment accounts

- rental fees for a safe deposit box to safe keep your investment paperwork, stock certificates, etc.

- tax preparation and tax advice fees

- hobby expenses

- fees to contest the IRS for any audit, collection or refund matter, such as accounting or legal fees

- If you are a salaried employee, and work from a home office “For the Convenience of your Employer”, you will no longer be able to deduct the expenses of that home office.

- If you are a salaried salesperson, you will no longer be able to deduct the cost of your travel to sales calls, or the meals and entertainment expenses you incurred to service your sales clients.

- Many companies will now have to implement Accountable Reimbursement Plans to reimburse these typical expenses incurred by such salaried employees, who in previous tax years could deduct the expenses on their tax returns, as an Itemized Deduction subject to the 2% Miscellaneous deduction threshold. The employee will now have to submit the expense receipts for company reimbursement.

- See this article about Company Reimbursement Plans posted by

- If you are a business owner or self-employed contractor, you can still deduct these types of expenses.

- You deduct these expenses on the Schedule C – that reports your business income & expenses

- The 7.5% AGI threshold for deducting Medical Expenses as an Itemized Deduction remains for 2018.

- The threshold will revert back to 10% of your AGI with the 2019 tax year

- There is now a $10,000 per tax return limit on deducting as an Itemized Deduction the aggregate total of:

- State & Local Property Taxes

- State and Local Income Taxes or State and Local Sales Tax

- Otherwise known as the SALT deduction. In previous tax years up through 2017, there was no limit on the SALT deduction. This deduction is recorded on the Schedule A for Itemized Deductions.

- This will adversely affect many of the higher taxed States, to the point four of those States have sued the IRS to have this provision repealed. See the lawsuit here: (4) States suit against the IRS. Since their residents will only be able to deduct $10,000 of State Income and Property Taxes, the lawsuit claims the new SALT provision unfairly raises the Federal Tax burden for their State’s residents. Conversely low tax States like Texas, have claimed for years they were subsidizing these higher taxed States. This is a political tax issue, that will ultimately and most probably be decided by the US Supreme Court.

- The new SALT deduction is half, or $5,000, for a Married Filing Separately taxpayer

- Prepaid 2018 property taxes will be deductible in the 2017 tax year, only if they were assessed by your State or Local Government in 2017, and you paid those 2018 assessed taxes in the 2017 tax year.

- The deduction for foreign property taxes, not related to a rental income property, is no longer allowed.

- There is a lower Mortgage Interest Deduction limit on new primary and secondary home mortgages

- For new mortgage applications begun after Dec. 15th, 2017

- Mortgages of $750,000 versus the previous $1,000,000 for all filers except Married Filing Separately

- Mortgages of $375,000 versus the previous $500,000 for a Married Filing Separately taxpayer

- The previous $1,000,000 limit still applies to mortgages closed on the purchase of a primary residence before January 1, 2018, and those who actually purchased the primary residence before April 1, 2018.

- Providing the above described new mortgage application process had begun by Dec. 15th, 2017.

- The previous $1,000,000 limit also applies to any older mortgages secured by December 15, 2017.

- These mortgage size limits then determine how much mortgage interest you can deduct each year

- An Example:

- Suppose you have an outstanding (pre Dec. 15th, 2017) combined mortgage value of $1,200,000 on your primary residence and 2nd vacation home and you paid $42,000 in mortgage interest at 3.5%.

- The “grandfathered” (pre Dec. 15th, 2017) combined mortgage debt limit is $1,000,000

- Your pro-rated mortgage debt limit is ($1,000,000) divided by ($1,200,000) equals 83.3333%

- ($42,000 in mortgage interest) times (83.3333% mortgage debt limit) equals $35,000

- Therefore your allowed mortgage interest deduction would be $35,000 on your 2018 tax year return. This being pro-rated down from the $42,000 value, as your total mortgage debt exceeded the $1,000,000 “grandfathered” limit by $200,000.

- Suppose you have an outstanding (pre Dec. 15th, 2017) combined mortgage value of $1,200,000 on your primary residence and 2nd vacation home and you paid $42,000 in mortgage interest at 3.5%.

- Interest on a Home Equity Loan is no longer deductible, unless used to improve your primary or secondary residence. The Home Equity Loan must also be secured by that referenced residence.

- Previously interest on up to $100,000 of a home equity loan was deductible, even if you used the proceeds for other expenses not related to improving your primary residence – like paying personal bills, funds for a child’s college tuition, or money to purchase a sailboat used at your vacation home.

- That added up to a combined limit of $1,100,000 for mortgages and the home equity loan

- The deduction limit was $50,000 on a home equity loan, for a Married Filing Separately taxpayer

- Now the proceeds from the home equity loan must be and/or have been used to improve your home – to report the interest you paid on the home equity loan as an Itemized Deduction on your 2018 tax return

- If the Home Equity Loan improves your primary or secondary home, you can deduct the interest

- The IRS has stated, in the below referenced article: The Home Equity Loan must have been used to buy, build or substantially improve the taxpayer’s home that secures the loan.

- This even includes older home equity loans taken out before the new legislation. If the proceeds of that older home equity loan were not use to improve your primary or secondary home, the interest you paid in 2018 on that home equity loan will no longer be deductible as an Itemized Deduction.

- If the Home Equity Loan improves your primary or secondary home, you can deduct the interest

- Your total new mortgage and new home equity debt cannot exceed the new $750,000 limit

- The previous $1,100,000 combined limit also has been lowered to $1,000,000 for any older mortgages or home equity loans secured before December 15, 2017.

- The older home equity loan, again, must have been used for improvements – to deduct that interest.

- See this article from the IRS, which clears up much of the confusion on this matter:

- See this article for several examples about how to still deduct pre-Dec. 15th, 2017 home mortgage interest and home equity debt interest – up to the $1,000,000 “grandfathered” mortgage limit. It was written by Gelman LLP, Certified Public Accountants and Business Advisors.

- Previously interest on up to $100,000 of a home equity loan was deductible, even if you used the proceeds for other expenses not related to improving your primary residence – like paying personal bills, funds for a child’s college tuition, or money to purchase a sailboat used at your vacation home.

- Mortgage Insurance Premiums are no longer deductible as an Itemized Deduction

- Lenders typically require mortgage insurance, until the FHA mortgage debt is reduced to 78% of the home’s value – for a 15-yr mortgage. A homeowner with a 30-yr FHA mortgage typically also has to make 5-years of mortgage payments before the bank will remove the requirement to have mortgage insurance. Your bank may have different rules, but these are typical rules for FHA loans.

- In previous tax years, including 2017, these mortgage insurance premiums were an Itemized Deduction.

- As a result of the Standard Deductions being doubled, fewer Taxpayers will Itemize their Deductions

- Therefore, some taxpayers will no longer benefit from a deduction for Charitable Contributions. A tax benefit for Charitable Contributions is allowed only if you Itemize your Deductions.

- Taxpayers can of course still donate to their favorite charities, but may not get a tax benefit, unless they qualify to claim the Itemized Deduction.

- Some higher income Taxpayers are now planning to pool their donations to report every two years, to then have their total Charitable Contributions be large enough to enable them to qualify for the Itemized Deduction benefit.

- Charitable Contribution rule changes

- You can now deduct up to 60% of your Adjusted Gross Income (AGI) for charitable contributions to public charities and certain private foundations

- It had been limited to 50% of your AGI in previous tax years

- You can no longer deduct the “Alumni Contribution” you make to your Alma Mater College, to get put on the list to purchase tickets to athletic events – like college football games.

- In previous years, you were allowed to deduct up to 80% of the value of such Alumni Contributions.

- You can now deduct up to 60% of your Adjusted Gross Income (AGI) for charitable contributions to public charities and certain private foundations

- Taxpayers can no longer deduct non-disaster Casualty and Theft Losses as an Itemized Deduction

- Unless incurred within a Federally Declared Disaster Area where the Casualty & Theft events happened

- Non disaster, personal casualty losses as a deduction have been “suspended” until January 1st, 2026.

- For example:

- If a tree falls on your house, if you total your car in an accident, or your diamond ring is stolen

- You can no longer claim those personal casualties, accidents, or thefts on your tax return, as an Itemized Deduction – unless they happened within a federally declared disaster area.

- If you receive taxable insurance reimbursements for non deductible personal casualty or theft losses, that create a taxable gain, you can offset those taxable reimbursements with the actual personal casualty or theft losses. This will help to reduce the amount of the insurance reimbursements that could qualify as taxable income gain.

- “Taxpayers with personal casualty losses not related to federally declared disasters may deduct those losses to the extent of personal casualty gains” per the IRS Code Sec. 165(h)(5)(B)

- This is the only exception to using personal non-disaster casualty and/or theft losses as a deduction

- Itemized Deduction for living expenses of Members of Congress while away from home eliminated

- Members of Congress previously could deduct up to $3,000 of yearly living expenses for their accommodations while working during the week in Washington, while away from their home State.

SECTION 4 ( topics #20 – #27 explained in detail )

Expired, Suspended, Eliminated or Modified Adjustments and Deductions

- A taxpayer can no longer deduct ordinary Moving Expenses related to moving to a new city for a new job

- Unless you are active duty in the Military and were ordered to move to a new permanent station of duty.

- This deduction has been “suspended” for all other non-military taxpayers until Jan. 1st, 2026

- The exclusion for company provided moving expense reimbursements also has been “suspended”

- Except again for active duty Military personnel

- This means if your company reimburses you for qualified moving expenses, they will now report that as Income on your W-2, and will withhold the proper amount of payroll taxes on the reimbursement.

- Qualified Bicycle Commuting Reimbursement Exclusion has been “suspended” until Jan. 1st, 2026

- Previously up to $20/month could be excluded from your taxable income, if your employer reimbursed you for such expenses you incurred, to commute to/from work on your bicycle.

- Such as a new bike, safety helmet, bike maintenance and repairs

- This was allowed so long as the Employee did not receive any other transit-related employee benefits

- Such as weekly or monthly subway fare cards, bus fare cards, and car parking facility reimbursements

- Previously up to $20/month could be excluded from your taxable income, if your employer reimbursed you for such expenses you incurred, to commute to/from work on your bicycle.

- The Tuition and Fees deduction was not extended for any tax year after 2017

- Previously you could deduct up to $4,000 as an Adjustment to income for Tuition expenses

- The Mortgage Debt Exclusion was not extended for any tax year after 2017

- Previously you could exclude from your Income up to $2 million of debt forgiven or canceled by your mortgage lender on a main home. Both mortgage restructurings and foreclosures qualified.

- Typically debt forgiveness is taxable income, unless you can prove you were insolvent the day before the debt was forgiven. An example is when credit card debt is forgiven.

- The financial crisis in 2008 necessitated the Mortgage Debt Exclusion provisions, as many people lost their homes. Having this large debt forgiveness value excluded from income helped people during these difficult financial times when they lost their primary residence to foreclosure.

- The Credit for Nonbusiness Energy Property was not extended for any tax year after 2017

- A tax credit of up to $500 was available to individuals for nonbusiness energy property, such as residential exterior doors and windows, insulation, heat pumps, furnaces, central air conditioners, and water heaters. These improvements were intended to make their homes more energy efficient.

- Alimony is no longer deducted as an Adjustment to Income for the payer, and no longer taxable as Ordinary Income to the recipient.

- This TCJA rule applies for new divorce or separation agreements executed after December 31st, 2018.

- For previous divorce and separation agreements executed before January 1st, 2019, the old rule applies:

- Alimony payments are a deduction – as an Adjustment to Income – for the payer of alimony

- Alimony payments received – are taxed as Ordinary Income – to the recipient of alimony

- Any older pre-2019 divorce or separation agreement can be legally altered to follow the new law if:

- If the agreement is changed after December 31st, 2018 to include additional language that:

- Acknowledges the new TCJA tax law changes regarding Alimony payments made and received

- States in the revised agreement the subsequent Alimony payments are no longer deductible to the payer and are no longer taxable to the recipient.

- Discharge of Student Loan Debt Exclusion item added

- The exclusion from income resulting from the discharge of student loan debt is expanded to include discharges resulting from the death or total and permanent disability of the student.

- The new law covers eligible loans discharged from January 1, 2018 to December 31, 2025.

- Currently if you work in certain jobs, you can also have portions of your Student Loan Debt forgiven, and excluded as taxable income. You need to officially enroll in such employment programs.

- For example, working as a Doctor in a rural area in great need of medical professionals

- Working as an Architect for Habitat for Humanity to help design and build low-income housing

- The exclusion from income resulting from the discharge of student loan debt is expanded to include discharges resulting from the death or total and permanent disability of the student.

- Expenses to offset Professional Gambling winnings

- Professional gamblers can now use the Sum of all losses, and all expenses incurred in conjunction with gambling transactions, to offset their legal gambling winnings, down to zero.

- These are called non-wagering expenses, for professional gamblers, who engage in legal gambling.

- Such as travel expenses to/from the Casino, betting fees, food & lodging, etc.

- They cannot show a loss on their legal gambling activity, to offset their other Ordinary Income.

- These are called non-wagering expenses, for professional gamblers, who engage in legal gambling.

- If a professional gambler reports his/her gambling winnings, expenses and losses on a Schedule C, he/she is then required to pay self-employment taxes on the net gambling winnings

- Unless you are a self-employed professional Gambler, you can only offset your gambling losses up to the amount of your gambling winnings. You cannot use the above mentioned non-wagering expenses to offset your recreational gambling winnings. You are considered a recreational gambler.

- You must use and qualify for the Itemized Deduction, to offset your winnings with your losses

- It is advised you keep a contemporaneous record of your yearly gambling activity so you can accurately prove to the IRS your gambling losses and/or expenses, that you used to offset your documented winnings. You will need this documentation if the IRS ever Audits your gambling activity.

- See this article from the American Gaming Association entitled:

- Professional gamblers can now use the Sum of all losses, and all expenses incurred in conjunction with gambling transactions, to offset their legal gambling winnings, down to zero.

SECTION 5 ( topics #28 – #30 explained in detail )

Changes to Tax Advantaged Savings Accounts for Education/Disabled Individuals & Backdoor Roth IRAs

- Distributions from 529 Qualified Tuition Program plans

- The legislation added the provision that up to a $10,000 per-student yearly maximum distribution, can now be used to pay for a K-12 public, private, or religious elementary or secondary school.

- such as kindergarten, grade school, middle school or high school.

- Previously 529 plan distributions were only allowed to pay for post-secondary institutions

- such as post high-school vocational schools, community colleges or 4-year degree universities

- These new 529 distribution rules do not apply to any Home Schooled children

- That proposed Home School addition did not make it into the final TCJA legislation

- The legislation added the provision that up to a $10,000 per-student yearly maximum distribution, can now be used to pay for a K-12 public, private, or religious elementary or secondary school.

- ABLE account contribution limits have been expanded for the Beneficiary

- ABLE accounts are tax-advantaged savings accounts, like an IRA, for people with disabilities

- The ABLE account assets do not affect, reduce, or limit the eligibility for the regular disability payments the person is currently receiving.

- ABLE accounts are an additional source of funds to pay yearly disability expenses.

- Distributed funds can be used to pay qualified expenses related to the disability – tax free.

- Typically only a total of $15,000 per year can be contributed to an ABLE account, by people other than the disabled person – such as family, relatives or friends of the disabled beneficiary.

- The total annual contributions by all participating individuals, including family and friends, for a single tax year is $15,000 – which is the Annual Gift Tax Exclusion amount.

- Contributions to an ABLE account are not tax-deductible to the giver or disabled individual

- All ABLE Account investment earnings remain untaxed providing the distributions from the account are used for “qualified disability expenses” for the disabled beneficiary.

- Now the beneficiary, the disabled person, can contribute an additional amount, being the lesser of:

- The Federal Poverty level for a 1-person household of $12,060 or

- The disabled person’s compensation for the year

- This added to the previously mentioned $15,000 allows a total yearly contribution of $27,060

- The disabled beneficiary can now also claim the Saver’s Credit on their personal income tax return

- Rollover funds from 529 Plan accounts are allowed without penalty, to be deposited in ABLE accounts

- This solves the problem of when a 529 Plan was setup at the child’s birth, before the disabled condition was identified and declared permanent – such as a permanent Autism disability. Previous to the TCJA these 529 Plans could not be rolled over into an ABLE account without penalties.

- ABLE accounts are tax-advantaged savings accounts, like an IRA, for people with disabilities

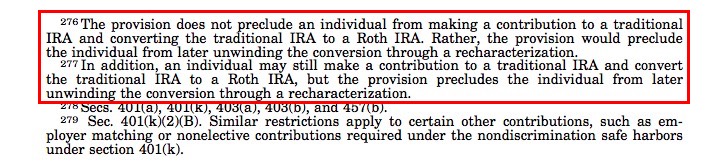

- Roth IRA Recharacterization Rules clarified and the Backdoor Roth IRA explained

- If a Taxpayer makes a deductible or non-deductible contribution to a traditional IRA, and before April 15th of the following year, converts it to a Roth IRA contribution – that Taxpayer cannot then convert, or recharacterize that new Roth IRA contribution back to a traditional IRA contribution.

- This rule also applies to so-called Backdoor Roth IRA Conversions.

- These are still allowed by the IRS, but you cannot now “unwind” a so-called Backdoor Roth IRA.

- A Backdoor Roth IRA is a method you can use to contribute to a Roth IRA, even though your high-income would normally prohibit that, under the direct Roth IRA contribution rules as shown below:

- If you are Unmarried, you must have a Modified Adjusted Gross Income (MAGI) under $135,000 to contribute to a Roth IRA for the 2018 tax year, and contributions are reduced starting at $120,000.

- If you are Married Filing Jointly, your MAGI must be less than $199,000 to contribute to a Roth IRA for the 2018 tax year, with the reductions beginning at $189,000.

- A Backdoor Roth IRA enables a high-income Taxpayer to still contribute to a Roth IRA, even though they cannot directly make Roth IRA contributions per the above described income limits.

- You begin by contributing to a traditional IRA then you immediately convert that into a Roth IRA.

- Step 1: A Backdoor Roth IRA works by opening a traditional IRA and making a fully non-deductible contribution to the traditional IRA – up to the yearly allowable contribution limit for your age.

- For example in the 2018 tax year, you can make a non-deductible contribution of up to $5,500 to a traditional IRA if you are under age 50. It is $6,500 if you are age 50 or older.

- Step 2: The traditional IRA then can be converted immediately, the same or next day, to a Roth IRA without any of the Roth income limitations – that your high-income would normally prevent you from making direct Roth IRA contributions.

- If you keep the non-deductible contribution money in the traditional IRA for a period of time, and it generates earnings, the conversion to a Backdoor Roth IRA becomes more complicated, as you have to consider the earnings into the conversion calculations, and pay taxes on the earnings.

- It is less complicated if you complete both transactions in the same calendar tax year. This makes the reporting of the transactions to the IRS appear in the same tax year, on that tax year’s tax return.

- You will receive the distribution form 1099-R from your Brokerage showing the distribution from your Traditional IRA that was then converted to your Roth IRA.

- You will receive the information reporting Form 5498 that shows the non-deductible contribution you made to the Traditional IRA, and the amount that was then converted to the Roth IRA.

- Your Brokerage can help you with this so-called Backdoor Roth IRA conversion.

- You might find the following article interesting, as it gives a history of the Backdoor Roth IRA and references a footnote in the TCJA legislation that specifically states the legality of this transaction. The article was written by an anonymous author called the Wall Street Physician.

- It’s Official: Backdoor Roth IRAs Are Legal!

- See that footnote below

- Step 1: A Backdoor Roth IRA works by opening a traditional IRA and making a fully non-deductible contribution to the traditional IRA – up to the yearly allowable contribution limit for your age.

- Recommendation #1: Be aware of the Pro-Rated Basis Rule if you own multiple traditional IRA accounts:

- If you have other existing traditional IRA accounts that were funded with pre-tax contributions or you made any previous tax year non-deductible contributions into these other traditional IRA accounts – you must take into consideration the remaining Basis in those older traditional IRA accounts. This will affect the taxable amount of the 2018 IRA conversion to the Roth IRA.

- The Pro-Rated Rule questions to consider:

- Are you converting money on which you have already taken a tax deduction? For example you have money in a Traditional IRA that qualified you for the IRA Deduction on your tax return. These are called pre-tax contributions and/or deductible contributions.

- Are you converting Non-Deductible Contributions? This is money you contributed to the Traditional IRA after you paid taxes on it, and you did not take the IRA Deduction on your tax return. These are called after-tax contributions and/or non-deductible contributions.

- Are you converting your entire Traditional IRA portfolio to the ROTH IRA, or are you keeping some money in the Traditional IRA? If you are keeping some money in the Traditional IRAs, you will be subject to the Pro-Rated Rule.

- Are you converting a Traditional IRA to a ROTH IRA, that has a mixture of past year’s deductible and non-deductible contributions? If so, you are subject to the Pro-Rated Rule.

- You owe taxes based on the proportion of your IRA moneys that are pre-tax and after-tax

- An Example:

- If you have a total of $100,000 of contributions in all of your Traditional IRA accounts with $10,000 of the money being a non-deductible contribution – categorized as an after-tax contribution. So $90,000 of the IRA moneys were made with pre-tax contributions, that gave you a tax benefit as an IRA Deduction off your yearly tax returns, for each tax year you made the Traditional IRA contributions.

- So $90,000 (pre-tax contributions) divided by $100,000 (total IRA contributions) equals 90%

- Therefore you will owe taxes on 90% of the money you convert to a ROTH IRA.

- If you have a total of $100,000 of contributions in all of your Traditional IRA accounts with $10,000 of the money being a non-deductible contribution – categorized as an after-tax contribution. So $90,000 of the IRA moneys were made with pre-tax contributions, that gave you a tax benefit as an IRA Deduction off your yearly tax returns, for each tax year you made the Traditional IRA contributions.

- Taxes Owed on the Earnings in the Traditional IRA account(s)

- If you earn profits in a Traditional IRA account funded only with pre-tax contributions, then you convert that to a ROTH IRA, you will pay tax on the entire conversion amount. That entire distribution is categorized as Ordinary Income.

- If you earn profits in a Traditional IRA account with a mixture of pre-tax and after-tax contributions, you pay tax only on the amount above the after-tax value.

- For Example:

- In year one you made a $5,000 pre-tax contribution to the Traditional IRA

- This would have given you an IRA Deduction on your tax return

- In year two you made a $5,000 after-tax contribution to the Traditional IRA

- This would be a non-deductible contribution and is considered “Basis” in the IRA

- The non-deductible contribution does not qualify you for the IRA Deduction on your tax return. It adds to the total funds in the IRA and creates “Basis” in the IRA

- In November of year three the account is worth $11,000

- Representing $1,000 in earnings in addition to the $10,000 in contributions

- When you convert the entire Traditional IRA to a ROTH IRA in November of the 3rd year:

- Your “Basis” in the IRA is $5,000 from the after-tax contribution in year two

- $11,000 (total value) minus $5,000 (basis) equals $6,000

- So you would pay taxes on $6,000 as Ordinary Income with the ROTH conversion

- In year one you made a $5,000 pre-tax contribution to the Traditional IRA

- For Example:

- See this article for further explanations of the Pro-Rated rule and its implications. It was written by William Perez and updated on 10/03/2018 at the Balance.com.

- The Pro-Rated Rule questions to consider:

- If you have other existing traditional IRA accounts that were funded with pre-tax contributions or you made any previous tax year non-deductible contributions into these other traditional IRA accounts – you must take into consideration the remaining Basis in those older traditional IRA accounts. This will affect the taxable amount of the 2018 IRA conversion to the Roth IRA.

- Recommendation #2: As an IRS Enrolled Agent I would strongly suggest you seek the advice of a tax professional if you have multiple traditional IRA accounts with pre-tax contributions and/or you have any non-deductible contribution Basis in any of those IRA accounts – and you are attempting to complete a Backdoor Roth IRA transaction. An Enrolled Agent, an Accountant, or a Tax Lawyer can provide you valuable advice how to best complete the Backdoor Roth IRA transaction to satisfy the strict IRS reporting requirements for such a situation.

SECTION 6 ( topics #31 – #32 explained in detail )

The Affordable Care Act changes

- Penalty for not having Qualified Health Insurance for all 12-months of the 2018 tax year

- This is referred to as the Individual Mandate, which was part of the Affordable Care Act, to induce people to buy health insurance, to even out the risk pools – between healthy and sick people. The penalty payments generate revenue to help pay for the Advanced Premium Tax Credits, which subsidize the monthly health insurance premiums for lower income taxpayers, who purchase health insurance through the Marketplace Health Insurance Exchanges.

- Taxpayers still face this penalty, called the Individual Shared Responsibility Payment, for the 2018 tax year, if they did not have qualified health insurance for all 12-months of the 2018 tax year.

- The yearly penalty is typically the greater of $650 per uninsured adult in the household, $347.50 per uninsured child in the household (up to a maximum of $2,085 per family), or 2.5% of your household income above the filing threshold for your filing status.

- The 2018 tax year is the last year for this penalty tax.

- The yearly penalty amount, as described above, is then pro-rated for only the months you did not have qualified health insurance.

- For example, let’s say you had the following situation in 2018 regarding your health insurance:

- You did not have qualified health insurance for (3) months in the 2018 tax year

- For the months of July, August and September

- Your income above the filing threshold for your filing status, subject to the Individual Shared Responsibility Payment penalty was $60,000

- The penalty is the higher of $650 or 2.5% of your income above the filing threshold

- 2.5% times $60,000 equals $1,500

- Your penalty would then be $1,500 for the entire year, if you didn’t have health insurance for all 12-months of the 2018 tax year

- The higher 2.5% penalty based on your 2018 income is $1,500, which works out to be $125/month

- So your 3-month penalty would be (3) * $125 = $375

- You did not have qualified health insurance for (3) months in the 2018 tax year

- The penalty tax amount will be zero, for tax years 2019 and after.

- The (2) Affordable Care Act taxes have been retained – for high-earner’s investment and salary income

- These taxes were part of the Affordable Care Act, to generate revenue to fund the Advanced Premium Tax Credit subsidies that some lower income taxpayers receive – on a monthly basis – to help them pay for health insurance policies purchased through the Marketplace Health Insurance Exchanges.

- The 3.8% Net Investment Income Tax – for high-earner investment income, has been retained

- The 0.9% Additional Medicare Tax – for high-earner salaried employees, has been retained

- The Premium Tax Credit and Advanced Premium Tax Credit have remained after the TCJA legislation

- If a Taxpayer has income within the range of 100% to 400% of the Federal Poverty Level for their filing status, then they can still qualify for the subsidy to help them pay for their monthly health insurance premiums, for policies they purchased from the Marketplace Health Insurance Exchanges.

- If they receive those subsidies every month – that is called the Advanced Premium Tax Credit

- If they choose to apply the total yearly amount of the subsidy to their refund and not receive the subsidies on a monthly basis – that is called the Premium Tax Credit. It is a refundable credit.

- If a Taxpayer has income within the range of 100% to 400% of the Federal Poverty Level for their filing status, then they can still qualify for the subsidy to help them pay for their monthly health insurance premiums, for policies they purchased from the Marketplace Health Insurance Exchanges.

SECTION 7 ( topics #33 – #36 explained in detail )

High-Earner Income changes

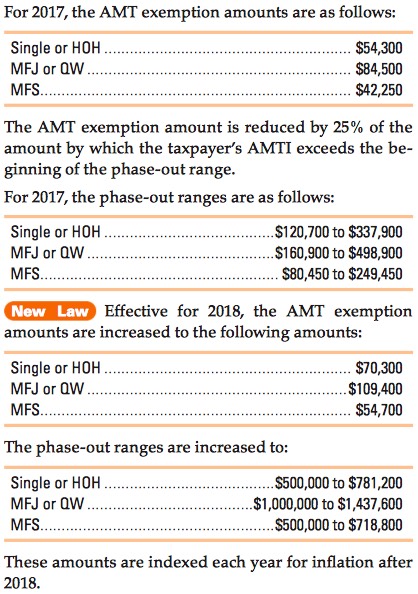

- The AMT (Alternative Minimum Tax) exemption amounts have increased significantly such that far fewer upper middle income taxpayers will have this AMT tax obligation.

- See the table below comparing the 2017 to the 2018 amounts. ©2018 The Tax Book

- The income phase-out range amounts have also increased, which will help taxpayers have a lower AMT obligation on their 2018 tax year return.

- The nonpartisan Tax Policy Center estimates that only about 200,000 tax filers are expected to owe the AMT in 2018 – much lower than the 5.25 million who they estimate would have owed under the old tax law.

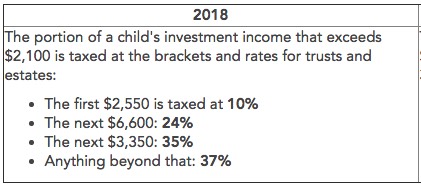

- The so-called Kiddie Tax was revised, to no longer use the Parent’s income tax rate to calculate the tax obligation on the Child’s unearned income – above the defined $2,100 threshold

- Using the Parent’s income tax rate has been “suspended” from January 1, 2018 to December 31, 2025

- The Child’s unearned income above $2,100 will now be taxed using the Trust and Estate tax rates

- The Kiddie Tax was enacted to prevent Parents from shifting their Investment Income gains from their higher tax bracket, to their Child’s lower tax bracket – by moving their Investments into a Child’s investment or bank account.

- It is a tax on a Child’s Investment and other Unearned Income over a defined threshold of $2,100.

- The Kiddie Tax affects children under the age of 18, or full-time students under the age of 24

- The unearned investment income of the Child can be reported in one of (2) ways on the 2018 tax return:

- On the Child’s tax return

- If the Child’s interest, dividends and other unearned income total more than $2,100, the amount of that unearned income above $2,100 will be subject to tax rates applicable to Trusts and Estates.

- The child’s unearned income above the $2,100 threshold previously used the Parent’s tax rates

- See this form and its instructions to report this Kiddie Tax income:

- The child’s Earned Income is now taxed using the Single tax bracket rates

- If the Child’s interest, dividends and other unearned income total more than $2,100, the amount of that unearned income above $2,100 will be subject to tax rates applicable to Trusts and Estates.

- On the Parent’s tax return

- If the Child only has interest, dividend, or capital gain distribution income, below $10,500, the Parents can elect to report that Child’s income on their tax return. The Child would then not be required to file their own tax return.

- The Child should be under the age of 19 at the end of the year or under the age of 24 at the end of the year if a full-time student.

- You will use form 8814 to claim this deduction.

- On the Child’s tax return

- This is a complicated subject, but as always, the tax software will help you calculate the Kiddie Tax.

- Or your tax professional can explain the Kiddie Tax implications for your 2018 tax year situation.

- See the tables below that document the tax rate changes using the Trust and Estate Tax Rates.

- ©2018 Intuit TurboTax blog

- Using the Parent’s income tax rate has been “suspended” from January 1, 2018 to December 31, 2025

- Deferral of income reporting for Private Company Stock Option Plans using new Section 83(i) Election

- The new TCJA tax law allows an employee to defer, for income tax purposes, the inclusion of income due to exercising certain Private Company stock options and/or restricted stock units (RSUs).

- Under the newly-enacted Internal Revenue Code Section 83(i), in cases where “qualified stock” is transferred to a “qualified employee”, the employee may elect to defer the recognition of taxable income on the transfer for up to five years.

- By electing to defer the income reporting component of the stock option exercise event, the taxpayer can defer the taxes usually due on the reported income resulting from the exercise of the stock options.

- This Section 83(i) Election is only applicable to employees of Private Companies whose stock is not currently publicly traded on an established US stock exchange.

- Per the Investopedia definition: “A private company is a firm held under private ownership. Private companies may issue stock and have shareholders, but their shares do not trade on public exchanges and are not issued through an initial public offering (IPO).”

- There are strict and very detailed reporting requirements for the Private Company to offer this sort of Section 83(i) income deferral benefit to their employees.

- It is recommended you consult the Accountant, Lawyer or Brokerage that setup your Private Company Stock Option Plan for advice on implementing this new Section 83(i) Election benefit.

- Refer to this article This New Election Allows Employees to Defer Income from Exercising Stock Options or RSUs for Up To Five Years Using Section 83(i) written By Jason Ackerman, of Wagner, Ferber, Fine & Ackerman, PLLC.

- Refer to this 2nd article New IRC Section 83(i) Introduces Election to Defer Tax on Certain Stock Options and RSUs written by Kevin Koscil and John Eagan of White and Williams LLP.

- Estate and Gift Tax Exemptions doubled

- For Estates of decedents dying and gifts made after December 31st, 2017 and before January 1st, 2026:

- The base estate and gift tax exemption amount has more than doubled

- $11.2 million in 2018 for unmarried taxpayers, up from $5.49 million in 2017

- $22.4 million in 2018 for married taxpayers, up from $10.98 million in 2017

- Adjusted for inflation for tax years after 2018

- Generation-skipping transfer tax thresholds have also been increased to the same levels

- $15,000 Annual Gift Tax Exclusion for the 2018 tax year

- The base estate and gift tax exemption amount has more than doubled

- For Estates of decedents dying and gifts made after December 31st, 2017 and before January 1st, 2026:

SECTION 8 ( topics #37 – #41 explained in detail )

Self-Employment and Small Business changes

- 20% Qualified Business Income (QBI) deduction for the Self-Employed and “Pass Through” entities

- This new Tax Law was enacted to give these smaller businesses a reduced tax benefit similar to the newly lowered flat 21% tax rate on Corporations. Congress intended to encourage these smaller unincorporated businesses to grow as they create hundreds of thousands of new jobs each year. Lower business taxes are viewed by many Members of Congress as an incentive for businesses to expand, to invest in new plants and equipment, to hire new workers and to grow.

- According to the Bureau of Labor Statistics, since the end of the Great Recession in 2009, small businesses have created 62 percent of all net new private-sector jobs.

- These unincorporated business entities are so-called “Pass Through” entities, as their business income and expenses are reported to their owners, partners, shareholders and members, to be listed on their personal form 1040 Individual tax returns.

- These particular business entities do not file Corporation tax returns. Most file informational returns to the IRS to report the entity income and expenses. The Partnership and S-Corp entities do not pay taxes at the entity level. These “Pass Through” business entities include:

- Sole Proprietors, Partnerships, S-Corporations (S-Corps), and LLC’s (Limited Liability Companies) treated as a Single Member LLC or a Multi Member LLC such as a Partnership LLC.

- The following (4) less common Qualified Business Income sources are not covered in this Blog

- Qualified Business Income that Trusts and/or Estates can earn

- Dividend income from Real Estate Investment Trusts (REITs)

- Income from a Publicly Traded Partnership (PTP)

- Dividend income from an Agricultural or Horticultural cooperative

- A Sole Proprietor and/or Single-Member LLC reports all their business income and expenses on the Schedule C, included with their personal Individual income tax return.

- A Partnership, an S-Corp and an LLC Partnership file informational tax returns to report the entity income and expenses to the IRS. They then issue K-1 reporting forms to the Partners, S-Corp Shareholders or LLC Partners – to document the income and expenses of the business entity – that then “passes through” and is reported on the Individual’s tax return.

- This new deduction can be up to 20% of their net Qualified Business Income. There are Taxable Income limitation thresholds and other requirements that can limit the QBI deduction.

- The lower value of the Taxable Income thresholds are:

- $157,500 of Taxable Income for unmarried Individuals or Married Filing Separately (MFS) person

- $315,000 of Taxable Income if filing a Married Filing Jointly return

- Taxable Income below these levels would then allow the full Qualified Business Income deduction if all the QBI deductions rules have been met

- The lower value of the Taxable Income thresholds are:

- For example, a married self-employed Plumber could possibly qualify for this additional 20% deduction of his Qualified Business Income, if he and his wife’s joint Taxable Income is below that $315,000 level.

- The deduction begins to phase-out above those levels and is limited at the top of the phase-out ranges

- For an unmarried or MFS Individual the phase-out range is between $157,500 up to $207,500

- For a Married Filing Jointly taxpayer the phase-out range is between $315,000 up to $415,000

- The treatment of the QBI deduction is different – when the Taxable Income is Between and/or Above the income thresholds – depending if the business is a “Specified Service Trade or Business” (SSTB) as compared to a non-service business referred to as a “Qualified Trade or Business”.

- Refer to the examples #1 through #6 below for an explanation of these differences

- A “Specified Service Trade or Business” (SSTB) is any trade or business providing services in the fields of health, law, accounting, actuarial science, performing arts, consulting, athletics, financial services, brokerage services, or any other trade or business where the taxpayer receives fees, compensation, or other income for endorsing products or services, for the use of the taxpayer’s image, likeness, name, signature, voice, trademark or any other symbols associated with the taxpayer’s identity, or for appearing at an event or on radio, television, or another media format. In addition, the trades or businesses of investing and investment management, trading or dealing in securities, partnership interest, or commodities – are Specified Service Trades or Businesses. Architects and Engineers are exempt, and are not classified as an (SSTB) type of business.

- This deduction is shown on line 9 of the new single-page 1040 form. It is subtracted from the Adjusted Gross Income, after the Standard or Itemized Deduction is subtracted. It helps reduce the Taxable Income value shown on line 10 of the new single-page 1040 form to zero. It cannot reduce the Taxable Income value below zero, as it is not a refundable credit, nor a refundable deduction.

- There are also limitations based on:

- (Taxable Income) minus ( Net Capital Gains + Qualified Dividends )

- Total Business Wage Income and Qualified Business Property Values

- Certain categories of a Specified Service Trade or Business

- For the simple example of the Plumber mentioned above:

- The final QBI deduction is the lesser of:

- 20% of the net Qualified Business Income (QBI) deduction, or

- 20% of the taxpayer’s [Taxable Income minus (Net Capital Gain+ Qualified Dividends)] they report on the tax return

- The final QBI deduction is the lesser of:

- For Example, let’s consider the following 2018 scenario for that Plumber:

- The married self-employed Plumber mentioned above had $78,000 of net Qualified Ordinary Business Income

- The potential 20% QBI deduction would be ($78,000) * 20% = $15,600

- The combined Taxable Income with his wife is $185,000 including $23,000 of Capital Gain Income

- The 20% Income Limitation would be [($185,000 minus $23,000 = $162,000) * 20%] = $32,400.

- Therefore the 20% QBI deduction of $15,600 is the lesser of the 20% Income Limitation of $32,400

- The line 9 QBI deduction on the new form 1040 would then be $15,600 in this example.

- This would then reduce their final line 10 Taxable Income by this $15,600 QBI deduction.

- See this draft worksheet from the IRS form 1040 Instructions used to calculate this simple example:

- The married self-employed Plumber mentioned above had $78,000 of net Qualified Ordinary Business Income

- The IRS is still finalizing the regulations for this new tax deduction, and as such this is the general theory of the deduction explained with this one very simple example of the Plumber.

- Much more information about this new small business deduction will be forthcoming before the upcoming tax season beginning in early January 2019.

- See this article Mechanics of the new Sec. 199A deduction for Qualified Business Income (QBI) for a detailed explanation of the many additional scenarios of this new 20% QBI business deduction. It was written by William A. Bailey, CPA, J.D., LL.M., for the Journal of Accountancy web site.

- If you self-prepare your tax return using software like TurboTax® the software interview will guide you through the process of qualifying for this new 20% QBI deduction.

- If you hire a tax professional to complete your tax returns, they will advise you about this deduction and their professional software will handle all the applicable calculations to qualify you for the deduction.

- This new Tax Law was enacted to give these smaller businesses a reduced tax benefit similar to the newly lowered flat 21% tax rate on Corporations. Congress intended to encourage these smaller unincorporated businesses to grow as they create hundreds of thousands of new jobs each year. Lower business taxes are viewed by many Members of Congress as an incentive for businesses to expand, to invest in new plants and equipment, to hire new workers and to grow.

- See the (6) Examples below with the accompanying PDF file explanations – to help explain some of the more complex scenarios under which a small business owner can take advantage of this new 20% QBI deduction.

- Example #1: the Plumber mentioned above where their combined Taxable Income is below the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- Click the PDF below for the Example #1 explanation and some definitions for the QBI deduction

- Example #2: the Plumber mentioned above where their combined Taxable Income is between the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- Click the PDF below for the Example #2 explanation

- Example #3: the Plumber mentioned above where their combined Taxable Income is above the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- The Plumber is not considered to be a “Specified Service Trade or Business” (SSTB) so they could still qualify for some of the QBI deduction, even though their combined Taxable Income is above the income phase-out level.

- Click the PDF below for the Example #3 explanation

- Example #4: A wife of a married couple who owns and operates an Accounting business. Her combined Taxable Income with her husband who is salaried as a junior stock broker is below the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- Her Accounting firm is considered a “Specified Service Trade or Business” (SSTB) but she would receive the full QBI deduction as they are below the income phaseout range.

- Click the PDF below for the Example #4 explanation

- Example #5: A wife of a married couple who owns and operates an Accounting business. Her combined Taxable Income with her husband who is salaried as a junior stock broker is between the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- Her Accounting firm is considered a “Specified Service Trade or Business” (SSTB) so they would receive a partial QBI deduction – due to the Taxable Income being within the phase-out range limitation.

- Click the PDF below for the Example #5 explanation. This explanation is 2-pages, to explain the more complicated calculation the IRS uses to determine this QBI deduction scenario #5.

- Example #6: A wife of a married couple who owns and operates an Accounting business. Her combined Taxable Income with her husband who is salaried as a senior stock broker is above the phase-out range between $315,000 up to $415,000 for their Married Filing Jointly status.

- Her Accounting firm is considered a “Specified Service Trade or Business” (SSTB) so they would receive no QBI deduction – as their combined income is above the top limit of the income phase-out range of $415,000.

- A SSTB business owner does not receive any QBI deduction above the income phase-out level.

- Click the PDF below for the Example #6 explanation

- QBI Example #6 – coming soon …

- Examples for Partnerships, S-Corps and Multi-Member LLCs are beyond the scope of this Blog.

- Recommendation: As an IRS Enrolled Agent I would strongly suggest you seek the advice of a tax professional for this new 20% QBI deduction. An Enrolled Agent, an Accountant, or a Tax Lawyer can provide you valuable advice how to best take advantage of this new small business tax deduction.

- More generous Depreciation rules for self-employed and pass-through entity business owners

- Bonus Depreciation allows 100% first-year deduction

- For property placed in service between Sept. 27th, 2017 to Jan. 1st, 2023

- Used property now qualifies. Previously only new property qualified for Bonus Depreciation.

- The Section 179 Expense deduction was doubled to up to $1 million, from the 2017 value of $500,000

- The phase-out threshold is now $2.5 million

- Qualified real property expanded to include:

- Personal property used predominately to furnish lodging

- Roofs, HVAC property, fire protection, alarm systems and security systems.

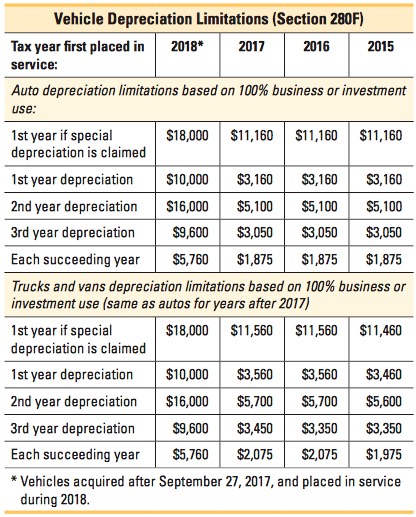

- Business Depreciation Auto Limits Tripled – for passenger vehicles, trucks and vans used in business, for which Bonus Depreciation is not claimed. See the table below. ©2018 The Tax Book

- For vehicles, trucks and vans placed in service after Dec. 31st, 2017