The IRS introduced a new single page 1040 form in June 2018, for the upcoming 2018 tax year. It is designed to be folded in half and mailed, if you are a taxpayer who still mails in your tax return. The IRS also introduced (6) new Schedules, numbered 1 through 6, to support this new 1040 form.

The previously used tax forms, the 1040EZ, 1040A, and the long 1040, have been retired by the IRS. They will not be used for any tax year after the most recently completed 2017 tax year. For the 2018 tax year and beyond, the new single page 1040 form will be used.

Only a relatively few number of taxpayers will have such a simple “Tax Story” that they can mail in the new 1-page 1040 form. Most taxpayers will need to use one or more of the (6) new Schedules, to list their additional sources of Income, Adjustments, Credits, Taxes and Payments. If so, they would have to include the required new Schedules with their mailed in tax return, that is designed to be folded in half and mailed.

Most taxpayers, over 90% according to the IRS, either use tax software to self-prepare their own tax return, or hire a tax professional to complete and file their tax return. That 90% of the taxpayer population will benefit from updated tax preparation software, that will automatically handle the new tax forms. Software like TurboTax® will be updated, as well as the professional software every tax professional uses to prepare and file a Client’s tax return.

What will be new is the final PDF copy, or paper printout of your 2018 tax return. Your tax information will be displayed on this new 1040 tax form, with one or more of the new (6) Schedules.

I explain the new 1040 form and the (6) new Schedules below, as to the new forms organization methodology the IRS is using, to populate your tax return information onto this new 2018 tax year return.

The IRS started publishing the drafts of these forms in late June 2018, and will continue issuing draft forms for comment and revision until the late Fall 2018. I will keep the form images in this Blog current, with the most recent IRS draft forms, as they are updated throughout the year.

Updated forms to this Blog on 08/14/2018.

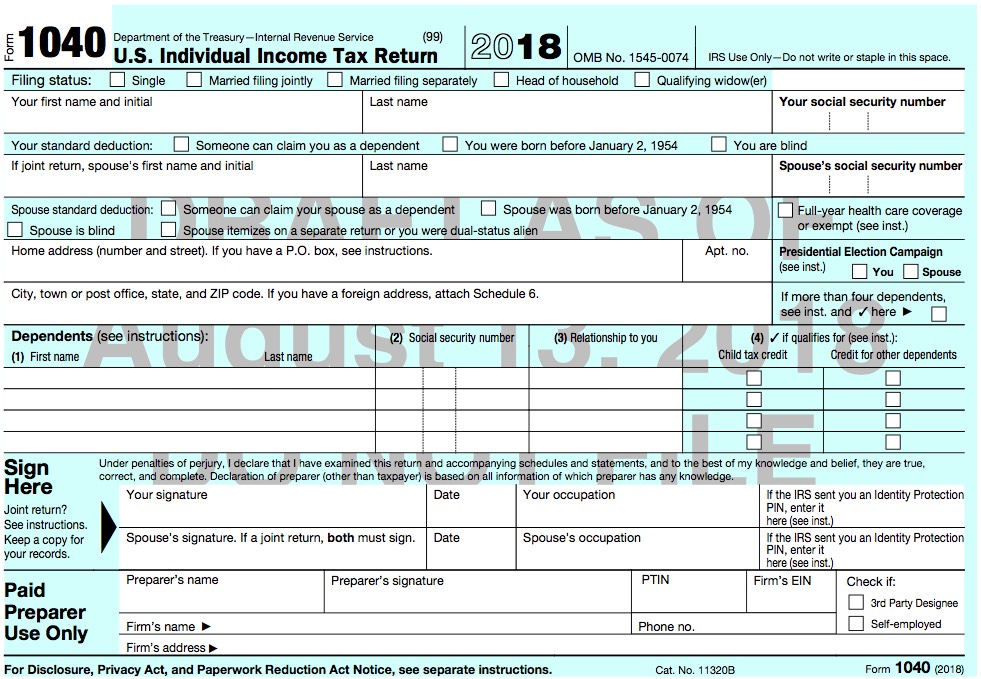

This is the top half of the new 1040 form

This is the Informational part of the new 1040 form. You describe the people listed on the tax return and define your filing status.

You answer questions about your Standard Deduction, and indicate that your Spouse is using Itemized Deductions, if you both are using the Married Filing Separately filing status.

You decide if you want $3 to go to the Presidential Election Campaign fund. You indicate if you had health insurance coverage for all of 2018.

You also sign and date your tax return, describe your and/or your spouse’s occupation, and list the paid preparer information, if a tax professional prepared the tax return on your behalf. You also indicate if you want your tax professional to be a 3rd Party Designee, which gives them permission to speak to the IRS, on your behalf, about the processing of your tax return.

If the IRS issued you or your spouse an Identity Protection PIN, you list that on this form. This guarantees the IRS only will accept a tax return from you, as they match the PIN to your personal information. If it does not match your information on record with the IRS, the tax return will be rejected.

Below is a line-by-line summary of the top half of the form:

- List your first and last name and your social security number.

- Add your middle initial if that is listed on your social security card

- List your Spouse’s first and last name, and their social security number

- Add Spouse’s middle initial if that is listed on their social security card

- Filing Status

- If you are Single, check that box.

- If you are Married Filing Jointly, check that box.

- If you are Married Filing Separately, you must list your Spouse’s social security number. Check the box Married Filing Separately.

- If you are using the Head of Household filing status, check that box

- If you are using the Qualifying Widow(er) filing status, check that box

- Standard Deduction information for the Primary taxpayer, listed first

- Check the box if someone can claim you as a Dependent on their tax return, such as a Parent

- Check the box if you were over age 65, at the end of 2018. This would mean you were born before January 2nd, 1954

- Check the box if you are blind

- Standard Deduction information for the Spouse, listed second

- Check the box if someone can claim you as a Dependent on their tax return, such as a Parent

- Check the box if you were over age 65, at the end of 2018. This would mean you were born before January 2nd, 1954

- Check the box if you are blind

- Check the box if your spouse itemized their deductions on a Married Filing Separately tax return.

- Check the box if you were a dual-status alien. This means you were a non-resident alien part of the year, and a resident alien the other part of the year.

- Fill in your full address, that you want the IRS to mail notices to

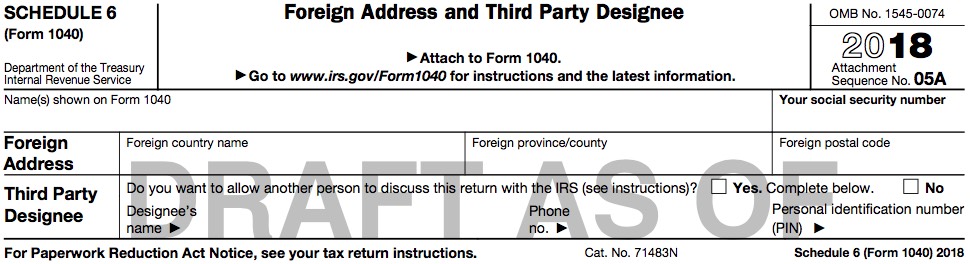

- If you list a Foreign Address, add that to the new Schedule 6.

- Check the box(s) if you want $3 to be allocated to the Presidential Election Campaign fund, on your and/or your spouse’s behalf. This will not decrease your refund, nor increase your tax due. It just transfers $3 from the Federal Government general fund, into this fund, in your name. See this Wikipedia link $3 to the Presidential Election Campaign.

- Check the box if you had qualified health insurance coverage for the entire 2018 tax year. There is still a penalty for the 2018 tax year, if you did not have health insurance for every month in 2018. The penalty will be zero, starting with the 2019 tax year, and for the tax years after 2019.

- List any Dependents you support in your household

- First & Last Name, social security number, and their relationship to you

- Check if they qualify for the Child Tax Credit, or the Credit for Other Dependents. The Child has to be under the age of 17 at the end of 2018, to qualify for the Child Tax Credit. The Other Dependent has to be someone you supported in your household, who does not qualify to be listed as your Dependent Child, and qualifies to be listed as an Other Dependent.

- You and/or your spouse must sign and date the tax return, and list each of your occupations. If the IRS has issued you and/or your spouse an Identity Protection PIN, you must list that on your tax return. The IRS uses this PIN to verify this is indeed your tax return. They will reject the tax return, if your personal information and the PIN does not match the information they have on record for you and/or your spouse, in their computers.

- The Paid Preparer must sign and date the tax return, if a tax professional prepared your tax return, and mailed / e-filed on your behalf. They also must list their PTIN number and their firm’s information. The PTIN is the Preparer Tax Identification Number, which is the registration number all paid preparers must have on record with the IRS, if they prepare tax returns for compensation. Do not use a tax preparer, if they don’t have a PTIN.

- 3rd Party Designee election. If this box is checked, you assign the tax preparer to be your 3rd Party Designee, for one year until the filing date the following year, usually April 15th. You are giving the tax preparer permission to call the IRS on your behalf, to answer any questions the IRS has about the processing of your tax return, the progress of the refund, or the processing of any payments you made. This does not give the tax preparer permission to represent you before the IRS, for any Examination, Audit, Collection, Payment Agreement, or Appeals matter. For those representation matters, you should sign a Power of Attorney with only a CPA, a Tax Attorney, or an Enrolled Agent. These are Enrolled Tax Experts who have permission to practice before the IRS, on behalf of their Clients.

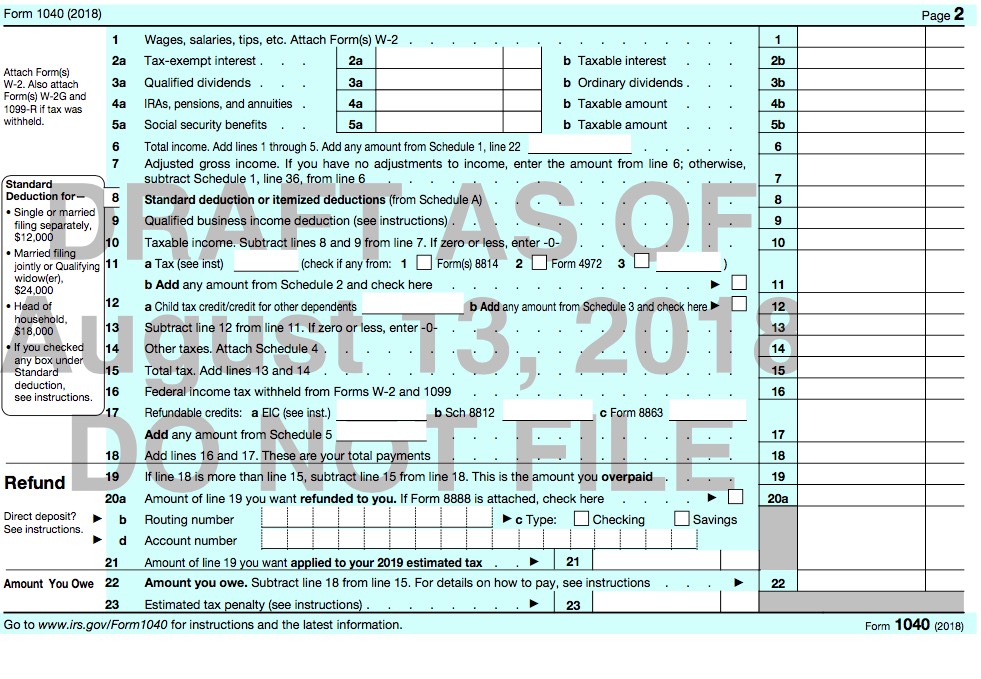

This is the bottom half of the new 1040 form

This is the abbreviated part of the new 1040 form, that previously took almost two pages to report the information about your income and deductions. Information now flows from the (6) new Schedules to the bottom half of this new 1040 form.

This page and the (6) new schedules – calculate and report your Income, Adjustments, Taxes, Nonrefundable Credits, Other Taxes, Refundable Credits, Payments, and Third Party Designee information.

The traditional “lettered” schedules that have been used for years, now flow to the new 1040 form and/or one of the (6) new schedules.

- Schedule A (Itemized Deductions) flows to line 8 of the new 1040

- Schedule B (Interest and Ordinary Dividends) flows to line 2b of the new 1040 for Interest, and line 3b of the new 1040 for Dividends.

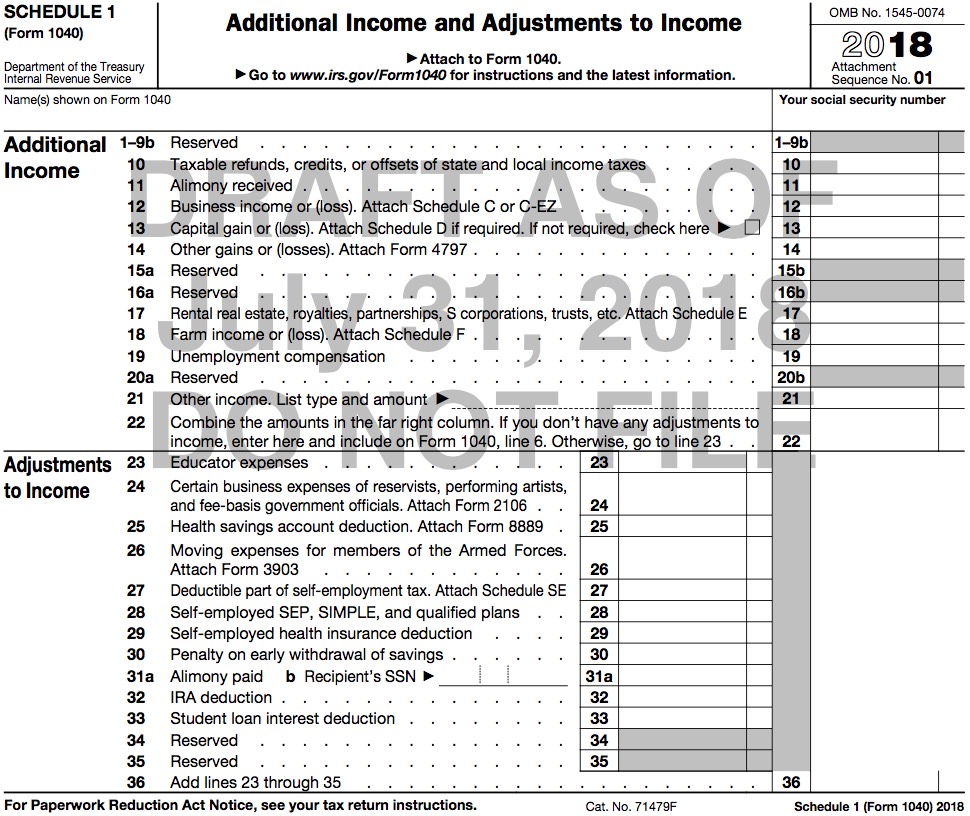

- Schedule C (Profit or Loss From Business) flows to Schedule 1, line 12.

- Schedule D (Capital Gains and Losses) flows to Schedule 1, line 13.

- Schedule E (Supplemental Income and Loss) flows to Schedule 1, line 17.

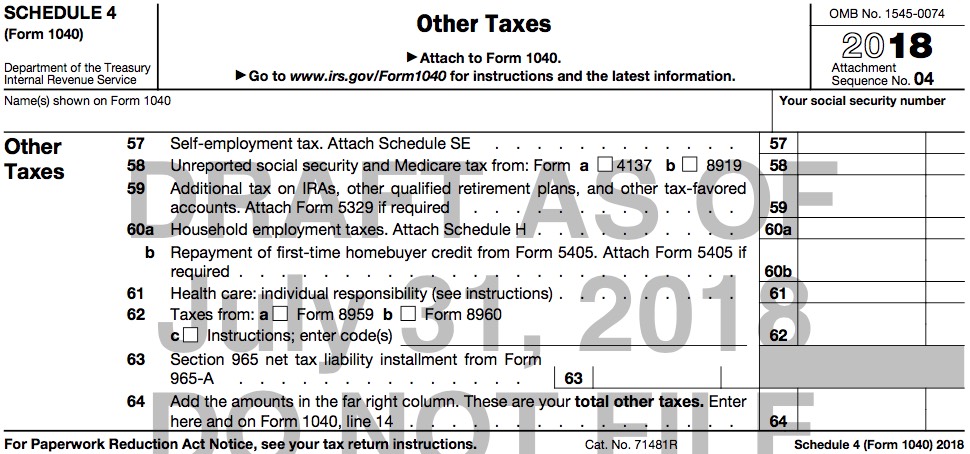

- Schedule SE (Self-Employment Tax) flows to Schedule 4, line 57.

Below is a line-by-line summary of the bottom half of the form:

- Income is reported on lines 1 through 5, on the new form 1040

- Wages, Salaries, Tips, etc. typically reported on your W-2

- Interest

- Dividends

- IRAs, Pensions and Annuities

- Social Security Benefits

- Additional income categories are reported on lines 10 through 21 on the new Schedule 1. These numbers then flow to this line 6, defining your Total Income for the tax year.

- Your Adjusted Gross Income is calculated on line 7 of the 1040, by adding the values on lines 1 through 6. If you have Adjustments to your income, those are calculated on the Schedule 1, in lines 23 through 36. Those total Adjustments are then subtracted from your line 6 Total Income. That then defines your final Adjusted Gross Income value reported on this line 7.

- Line 8 lists your Standard Deduction, or your larger Itemized Deduction, that is calculated on the Schedule A and reported back to this line 8.

- Line 9 lists the new 20% deduction for Qualified Business Income. This affects self-employed individuals who operate as a Sole Proprietorship. It also affects businesses run as an S-Corp, Partnership, Single-Member LLC or a Partnership LLC. These business entities can now deduct up to 20% of their net income to reduce their final Taxable Income value. There is a phase-out of this new deduction above certain income levels. This new Tax Law was enacted to give these smaller businesses a benefit similar to the new flat 21% tax on Corporations. There are many limitations and qualifications to this new deduction, that affect if the full 20% deduction can be taken. The IRS will clarify the instructions before tax season starts.

- Line 10 lists your Taxable Income. This is the value that is used to calculate your Tax Obligation for the tax year, based on your income, adjustments and deductions – listed in lines 1 through 9 above.

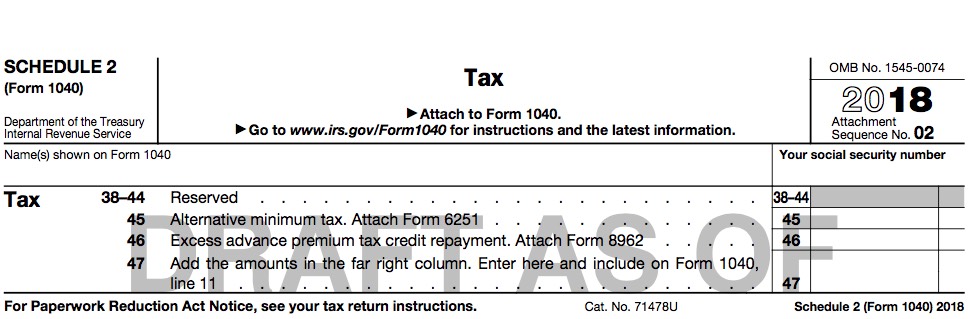

- Line 11 lists your initial Tax Obligation, calculated from the Tax Tables and from any additional taxes listed on the Schedule 2. Tax from forms 8814 (Parent’s Election to report Child’s Interest & Dividends) and 4972 (Lump Sum Distributions) and Other tax calculation forms are also totaled here.

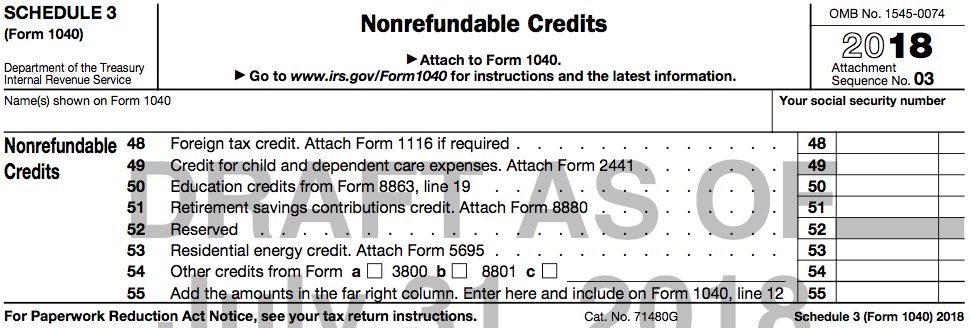

- Line 12 calculates any Nonrefundable Credits you qualify for, that can reduce your line 11 Tax Obligation to zero, but not below zero. These are the Child Tax Credit, the Other Dependent Credit, and any other nonrefundable credits calculated on the Schedule 3.

- Line 13 subtracts these Nonrefundable Credits from your Tax Obligation on line 11. Line 13 can be reduced to zero, but not below zero.

- Line 14 adds any additional Other Taxes, calculated on Schedule 4.

- Line 15 is your Total Tax Obligation, which adds any remaining tax from line 13, to any additional Other Tax listed on line 14.

- Line 16 shows any income tax withheld from your paycheck, shown on your W-2 form. It also lists any tax withheld and shown on 1099 forms, like a 1099-G for Unemployment Insurance, or an SSA-1099 for Social Security benefit payments.

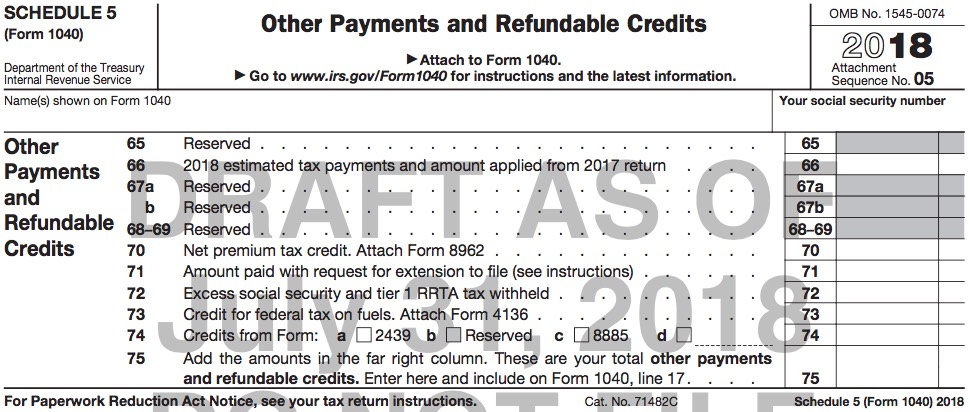

- Line 17 shows any Refundable Credits you qualify for, and any Other Tax Payments you made or qualified for during the tax year, like Quarterly Estimated Payments. These are calculated on the Schedule 5. The Earned Income Credit (EIC), Additional Child Tax Credit (form 8812), and the Education Credits (form 8863) are listed here also.

- Line 18 adds lines 16 & 17, to arrive at your Total Payments.

- Line 19 lists your refund amount, if your line 18 Payments, are larger than your line 15 Total Tax.

- Lines 20a, b, c, d list the Refund amount you want to receive, and allows you to direct your refund to your bank account, or even to more than one financial account. The form 8888 allows you to split your refund between multiple accounts. For example, you could put half of your refund into your checking account, and the other half into your IRA account.

- Line 21 allows you to apply some or all of your refund, towards your 2019 tax year Estimated tax payments.

- Line 22 shows the amount of tax you owe, if your line 15 Total Tax, is larger than your line 18 Total Payments. You can also instruct the IRS to directly debit the tax you owe, from your bank account, on any date between when you file the tax return, and the usual April 15th due date. You can also setup a payment agreement, to pay the tax over a longer period of time, although you will pay the IRS additional interest and any applicable penalties until the full balance is paid off.

- Line 23 shows the Estimated Tax Penalty, if you owe more than $1,000 of tax and you did not make Estimated Tax Payments during the tax year.

This is the new Schedule 1 (Form 1040)

This is the new Schedule 2 (Form 1040)

This is the new Schedule 3 (Form 1040)

This is the new Schedule 4 (Form 1040)

This is the new Schedule 5 (Form 1040)

This is the new Schedule 6 (Form 1040)

Some final thoughts on this “Tax Simplification” that the President and the members of Congress promised.

- The President and Congress did not simplify the Tax Code, except for removing the Personal Exemption and doubling the Standard Deduction. They added some provisions that actually add complications, like the line 9 Qualified Business Income deduction.

- The Child Tax Credit has doubled to $2,000, and the income phase-out levels have been raised substantially, so many more Taxpayers will now qualify for the new $2,000 Child Tax Credit.

- The President kept his promise, that taxpayers could fill out their tax return on a “post card” to be mailed in. That is why the IRS created the new 1-page 1040 form, that can be folded in half and mailed in. But very few taxpayers have such a simple tax return, that can be solely described on the new 1-page 1040 form, without using one or more of the new (6) Schedules that flow information to the new single-page 1040 form.

- Congress eliminated popular deductions many taxpayers benefited from

- There is now a $10,000 per tax return limit, on deducting State & Local Taxes, otherwise known as the SALT deduction

- Unless you are in the Military, a taxpayer can no longer deduct ordinary Moving Expenses related to moving to a new city for a new job

- Taxpayers can no longer deduct Unreimbursed Business and Education Expenses related to their salary job. All other Miscellaneous Deductions formerly allowed above 2% of your Adjusted Gross Income – also have been eliminated.

- As a result of the Standard Deductions being doubled, fewer Taxpayers will be Itemizing their Deductions. Therefore, they will no longer be allowed to gain a deduction for Charitable Contributions, as those are allowed only if you Itemize your Deductions.

- Taxpayers can no longer deduct Casualty and Theft Losses as an Itemized Deduction, unless incurred because of a Federally Declared Disaster Area.

Software like TurboTax® will be updated to reflect the new tax forms. Your tax professional will be trained to understand the new Tax Laws and forms, and his/her tax software will be updated.

Your final PDF or printed tax returns, though, will have an entirely new look for 2018.

Feel free to send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2018 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2018 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.