Seven new income categories are added to the form 1040A, and the $1,500 limit on Taxable Interest is removed.

- Taxable Interest Cap removed:

- If you remember, the form 1040EZ limited the Taxable Interest you could report, to $1,500 or less. The 1040A removes that cap, so you can report Taxable Interest over $1,500. You must, though, report that greater than $1,500 Taxable Interest on the Schedule B form. You list each payer of Taxable Interest on the IRS Schedule B – so it matches the records on file with the IRS. If you earn over $10 in Taxable Interest, your bank or broker is required to send you a form 1099-INT that reports that interest. The 1099-INT form has all the information you need to include on your tax return. Taxable Interest is shown on line 8a of the form 1040A. Click this link form 1099-INT to see the form.

- Tax-Exempt Interest

- Tax-Exempt Interest is typically paid if you own a Municipal Bond, or own a mutual fund that contains Municipal Bonds. The interest you earn on these types of bonds is not taxable on your IRS tax return. You still are required to report the Tax-Exempt Interest on your tax return, as a record-keeping match with the IRS computers. This type of interest is also reported to you on a 1099-INT form.

- Many States also do not tax interest earned from Municipal Bonds – provided the bonds are issued from their State. For instance, I live in New York City, and if I received interest from any Municipal Bonds issued within New York State, they would be tax free on my New York State tax return. If I owned Municipal Bonds from New Jersey, then they would be taxed on my New York State tax return. Your tax professional can help determine this for you – if your State will tax the interest you received from Municipal Bonds. Tax-Exempt Interest is shown on line 8b of the form 1040A.

Ordinary Dividends are the share of a company’s profits, passed onto the shareholders, usually paid on a quarterly basis. You could receive these if you own a stock that pays dividends, or from a mutual fund that contains dividend paying stocks in their portfolio. Dividends are reported to you on the form 1099-DIV. Click this link form 1099-DIV for the form.

Ordinary Dividends are included in your Total Income, and are taxed at one of the (7) regular Individual Income tax rates of 10%, 15%, 25%, 28%, 33%, 35% & 39.6%. Ordinary Dividends are shown on line 9a of the form 1040A. If you received over $1,500 in Ordinary Dividends for the tax year, these must also be reported on the Schedule B. You list each payer of Ordinary Dividends on the Schedule B, so the IRS can cross-match these with their computer records.

Qualified Dividends are eligible to be taxed a lower tax rate, called the Capital Gains tax rates – of 0%, 15%, or 20%. You pay substantially less tax if your dividends are eligible to be Qualified Dividends.

- Taxpayers in the regular Individual income tax brackets of 10%/15% – pay a 0% Capital Gains tax rate.

- Taxpayers in the 25%/28%/33%/35% regular Individual income tax brackets – pay a 15% Capital Gains tax rate.

- Taxpayers in the 39.6% regular Individual income tax bracket – pay a 20% Capital Gains tax rate.

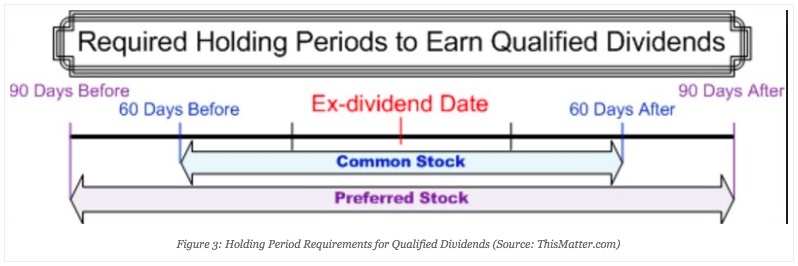

You must own the Stock that paid the dividends, for an IRS specified holding period, for those dividends to be Qualified Dividends. That is typically owning the Stock for more than 60 days during the 121-day period that began 60-days before the ex-dividend date. The ex-dividend date is the first day following the declaration of a dividend on which the purchaser of a stock is not entitled to receive the next dividend payment.

Fortunately you do not have to calculate this IRS holding period for yourself, because the stock company or brokerage firm will determine this for you, if your dividends are to be Qualified.

They then report those to you on the 1099-DIV form, usually by the end of February. Qualified Dividends are shown on line 9b of the form 1040A.

Capital Gain Distributions are typically paid to you, when a mutual fund you own shares in, sells a Stock or Asset for a profit. That sale of an asset for a profit – or gain – is called a Capital Gain. The mutual fund must pass that Capital Gain onto you, as a shareholder of the mutual fund. If the mutual fund held that underlying Stock or Asset for more than one year, the Capital Gain reported to you is a long-term gain, subject to the more favorable Capital Gain tax rates discussed earlier. If the mutual fund held the underlying Stock or Asset for less than one year, the gain to you is short-term. Short-term gains then are reported to you as an Ordinary Dividend, taxable at regular Individual income tax rates, as discussed earlier.

The brokerage firm or mutual fund company will send you a form called a 1099-Consolidated statement which lists these Capital Gain Distributions on line 2a and/or the Ordinary Dividends on line 1a. It has everything you need to report these transactions on your tax return. Click this link form 1099-Consolidated (TD AmeriTrade sample) for a sample of this form. Capital Gain Distributions are shown on line 10 of the form 1040A.

If you only have Dividends and Capital Gain Distributions, the brokerage could just send you a 1099-DIV form, that also can list Capital Gain Distributions on line 2a of that 1099-DIV form. Most often, though, they will send you the 1099-Consolidated form.

IRA Distributions are payments to you, from any of your IRA retirement accounts. They are reported to you on the form 1099-R. Click this link form 1099-R for the form. Distributions from a regular IRA account are taxed as Ordinary Income. Distributions from a ROTH IRA are not taxed, but still have to be reported on your tax return. If you are under age 59 1/2, you most often have to pay a 10% early withdrawal penalty tax – unless you qualify for an exception. If you “Roll Over” another retirement account into your existing IRA, most often this is a tax-free exchange – providing you followed the IRS rollover rules. You list the total IRA distribution amount on line 11a of the form 1040A. If any of that amount is taxable, that is listed on line 11b of the 1040A.

Your broker should indicate with the proper code on the 1099-R form, if any of the IRA distribution is taxable. Your tax professional can also help you determine this – particularly if any of the distribution will be taxable.

Pension and Annuity Distributions are distributions to you from your retirement accounts, from the company or institution you worked for. These are reported on lines 12a and 12b of the form 1040A.

Pensions provide you a guaranteed monthly benefit upon your retirement, based on your years of service, your salary, your age at the time of retirement, and the distribution rules of the pension. Some pensions are tax free, others are partially taxable, and others are fully taxable. This depends on the rules of the pension, your situation as you worked, and when you retired. Your yearly pension distributions are reported to you on a 1099-R form, which will typically tell you how much of the pension is taxable. Many companies and institutions have stopped offering traditional pensions to their new employees, and instead offer them a 401(k) plan which more closely resembles a traditional IRA account.

Annuities are an Insurance contract, that also pays out a fixed monthly amount to you during your retirement. Sometimes an annuity is offered to older employees, instead of a lump-sum buyout of their traditional defined benefit pension. This might happen when a large Company needs to reduce their traditional pension exposure, and so in turn offers older employees an incentive to retire early – relieving the Company of the longer-term pension liability. An annuity will pay you a fixed monthly amount, typically throughout your entire retirement. Your yearly annuity distributions are reported to you on the same 1099-R form, which will also indicate if the annuity payments are taxable.

Social Security Benefits are paid to you upon your retirement. You can begin receiving benefits as early as age 62, and the latest when you turn 70. You will receive your “full benefits” if you wait to start until your full retirement age, as defined by this table Full Retirement Age Table for SS Benefits. You will receive less than your full benefits, if you begin receiving Social Security benefits before your full retirement age. You could receive much more, if you wait until age 70. The Benefits are reported to you on the SSA-1099 form. Click this link form SSA-1099 for the form.

Beginning in 1984, some of your yearly Social Security Benefits could be taxable – up to 50%. In 1993 that was increased to 85% that could be taxable. This was done in 1984 to “save” Social Security and was the agreement negotiated between President Reagan and House Speaker Tip O’Neal. That rule is still in effect today, with up to 85% taxable. Many taxpayers are not aware that Social Security Benefits can be taxed, and receive this unpleasant surprise at tax time.

If you only receive Social Security Benefits with no other income, none is taxable on your Federal Tax return. If you receive a taxable Pension, Annuity or other taxable Income, then up to 85% of your Social Security might have to be reported as taxable. An IRS formula and worksheet determines this for you on Taxable Social Security Benefits Worksheet. All of the tax software used today also automatically calculates this for you, and completes the worksheet.

This formula takes into account half of your Social Security Benefits, and then adds that to any other taxable income and tax-exempt interest you received during the tax year. For a Single, Head of Household, Qualifying Widow(er), or Married Filing Separately taxpayer, if that total is over $25,000 – then some of your Social Security Benefits would be taxable, up to a maximum of 85%. For a Married Filing Jointly couple, that total has to be over $32,000. All tax software automatically calculates this for you, to determine if any or up to 85% of your Social Security Benefits are reported as taxable income.

You list the total Social Security Benefits distribution amount on line 14a of the form 1040A. If any of that amount is taxable, that is listed on line 14b of the 1040A.

Click the link below for the next Blog post to learn about the (4) new Adjustments to income that have been added to the form 1040A.

The 1040A: (4) New Adjustment categories

Feel free to comment on these blog posts, or send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2017 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2017 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.