Cost of Goods Sold (COGS) is the method the IRS uses to define the cost you invested to produce your new inventory for sale, during the tax year.

This has been discussed in (2) previous posts. See The 1040: The Schedule C: Part I – Income for the Schedule C, line 4 description of COGS. See also the blog post The 1040: The Schedule C: Part II – Expenses for the line 22 description of Supplies and how they relate to the COGS. The IRS states in the instructions for the Schedule C on page C-14 that:

“In most cases, if you engaged in a trade or business in which the production, purchase, or sale of merchandise was an income-producing factor, you must take inventories into account at the beginning and end of your tax year.”

A great IRS resource is Publication 334-Tax Guide for Small Business.

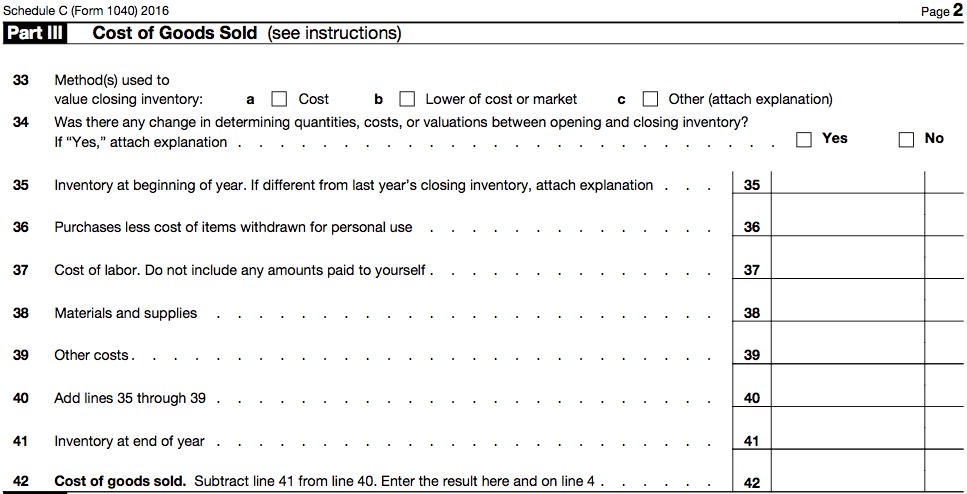

Part III of the Schedule C has the lines 33 through 42 that calculate the Cost of Goods Sold for your Business activity that sells from inventory. The line 42 value then flows to line 4 on page 1 of the Schedule C.

- Inventory can be defined by:

- Product you have ready for sale to your Customers, from the previous tax year. This is most commonly called Beginning Inventory you have on January 1st of the new tax year – ready to be sold to your Customers.

- Raw materials you purchase to produce the product you sell

- Work in progress inventory that is not complete, ready to sell

- New Finished products, ready to sell, that you manufacture during the current tax year, that adds to your available inventory to be sold.

- Supplies or Raw Materials that physically become part of the finished product that you then sell to your Customers.

- line 33: Method used to value closing inventory tells the IRS what method you used to arrive at the value of your inventory at the end of the year on December 31st at the close of business that day. Refer to your Accountant or Bookkeeper for the method your Business uses to value inventory.

- The Cost method uses the actual costs you incurred during the tax year to purchase the raw materials to produce the product, plus any labor you paid to make the products. This is the most common method used to value Inventory.

- It does not include any shipping costs you incurred, to deliver the purchased product to your Customers. Those are ordinary expenses related to Sales, not to Cost of Goods Sold.

- To help keep track of varying Inventory costs during the year, many companies use the FIFO or First In, First Out method to account for their current Inventory value. This means the First inventory product produced, is the First product to be sold to a Customer.

- The accounting or bookkeeping software used by the Business then keeps track of this flow of new product produced, and old product sold, thus moving out of inventory.

- Companies can also use the LIFO, or Last In, First Out method to value their inventory during the year. This means the Last or most recent inventory product that was produced, is the First product to be sold to a Customer.

- The Lower of Cost or Market method values the inventory at its original Cost, or the current Market value on December 31st – whichever is lower. This helps companies whose inventory might decline in value during the year, below the costs it took to originally produce the inventory.

- Any Other method approved by the IRS. You must attach a statement to your tax return, to explain this Other method to the IRS.

- The Cost method uses the actual costs you incurred during the tax year to purchase the raw materials to produce the product, plus any labor you paid to make the products. This is the most common method used to value Inventory.

line 34: Change in determining value of Opening/Closing inventory tells the IRS with a Yes/No answer if this is true. You have to attach an explanation to the IRS with your tax return, if you changed how you valued your inventory in January, as compared to how you now value your year-end inventory on December 31st.

line 35: Inventory at Beginning of Year is the wholesale value of your entire remaining inventory at the close of Business on December 31st of the previous tax year – based on your inventory value method.

line 36: Purchases less cost of items withdrawn for Personal Use is the entire expense you incurred during the tax year, to add to your inventory or to manufacture your product you sell from inventory. This includes the raw materials and supplies that actually go into the product that will be sold. These purchases throughout the year allowed you to produce additional products to add to your inventory, ready to be sold. If you used any of the products or inventory for your Personal Use, subtract the value of those items from this expense value.

line 37: Cost of Labor is the expense you incurred to pay your employees or other personnel to directly produce your product to add new completed inventory to your Business, ready to be sold to your Customers.

line 38: Materials and Supplies such as hardware and chemicals, used in manufacturing goods. Or perhaps fabric dyes you need to make the purse straps you now sell through your Internet based home business.

line 39: Other Costs include any other direct expense you need to make or manufacture your product as new inventory. Such as:

- storage containers to hold the raw materials that go into the product

- cost of freight and shipping to get the raw materials to your Business

- overhead expenses you have for your dedicated manufacturing facility

- packaging for the product so it is ready for sale

line 40: Add lines 35 through 39 which accounts for your Beginning Inventory and the Expenses during the year you incurred to produce new Inventory – ready to be sold to your Customers.

line 41: Inventory at the End of the Year is the total wholesale value of your Inventory at the close of Business on December 31st of the current tax year, based on your inventory value method.

line 42: Cost of Goods Sold is the result of subtracting your line 41 year-end inventory value, from the line 40 beginning inventory plus inventory expense value you incurred during the year.

See the example below of how to calculate the Cost of Goods sold:

- You started a new home business selling fashion accessories on the Internet in February of 2016. You therefore had no beginning inventory.

- During the course of the year you purchased $15,000 of the raw materials, fabric and trimmings required to manufacture your wholesale-priced fashion accessories, that you then sold through your Internet-based fashion business for a nice profit at regular retail prices. These include only the purchases that directly go into the finished product, ready for sale to your Customers. It would also include the $1,500 in fees you paid a Sample Maker who sewed your finished garments together.

- At the end of the business day on December 31st of this first year, the value of your remaining in-progress and finished – but still unsold wholesale inventory – was $4,500. This wholesale inventory is ready to be sold January 1st of the following year at the full retail price, as new orders begin in the New Year for your popular products.

- Your Cost of Goods Sold is therefore = $12,000, based on this formula:

- Inventory at beginning of the year in February 2016 = $0

- Raw materials purchased during the 2016 tax year = $15,000

- Sample Maker fees for 2016 tax year = $1,500

- $15,000 + $1,500 = $16,500

- Inventory at the end of the year on December 31st, 2016 = $4,500

- $16,500 minus $4,500 = $12,000 which is your Cost of Goods Sold

Click on the hyperlink below to learn how to input the Business Vehicle Information required in part IV of the Schedule C, and the form 4562 if you are required to Depreciate the cost of your Business Vehicle(s).

The 1040 – The Schedule C: Part IV – Vehicle Information & form 4562-Depreciation

Feel free to comment on these blog posts, or send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2017 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2017 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.