The form 1040A adds five tax credits that can reduce your tax liability to zero, but not below zero. These reduce your line 30 Initial Tax Liability value, which is the sum of the line 28 Initial Tax, and any line 29 repayments of the Advance Premium Tax Credit you had to return.

These (5) credits are called “Nonrefundable” because they can only reduce your tax liability to zero. They cannot produce a refund for you, beyond their ability to reduce your tax liability to zero. They are:

- Line 31 – Credit for Child and Dependent Care Expenses

- Line 32 – Credit for the Elderly or Disabled

- Line 33 – Education Credits

- Line 34 – Retirement Savings Contribution Credit

- Line 35 – Child Tax Credit

These types of tax credits have many rules, tests, and qualifications you must meet to take advantage of their tax saving features. The explanations below give a general overview of the credits – so you can determine if you might qualify for them. You can click the blue hyperlinks for each credit to see its associated IRS tax form and the instructions for the form.

A 100% full explanation of these sorts of credits – is beyond the scope of this Blog, as it is already a rather long Blog post in its current form. Feel free to post a comment, or email me at Mike@TaxesAreEasy.com, if you have questions or need further explanations of any of these (5) credits.

The Credit for Child and Dependent Care Expenses is a deduction for the costs you incurred for child care for your Qualifying Child under the age of 13. It also applies to care provided to a disabled spouse or other disabled dependent you support and claim on your tax return.

The child and/or dependent care services thus allowed you to work, or look for work – as you did not have to care for the child or disabled dependent during your work day. This work requirement is the key.

A married couple must have both spouses working, or looking for work, to qualify for this credit. Or one or both spouses can be a full-time student. The credit is not allowed if one spouse serves as the full-time homemaker and does not work outside the home. Both married spouses must have “earned income” from a job or self-employment to qualify for this credit, unless they can be qualified as a student.

A Married Filing Separately taxpayer cannot use this credit unless the following conditions apply. They would then be considered “Unmarried” and would qualify for this credit.

- You lived apart from your spouse the last six months of the tax year

- Your home was the qualifying child’s or disabled dependent’s main home for more than half of the year.

- You paid more than half of the costs of keeping up this home for the year

You can pay the Child Care or Dependent Care facility directly, or your employer might have given you money for the care, or the employer paid the facility directly. Employer dependent care benefits are shown in box 10 on your W-2. These are typically a non-taxable fringe benefit to you. Click this link form W-2 with Box 10 to see a W-2 with Box 10 highlighted.

You must use the IRS form 2441 to exclude those employer-provided child care or dependent care benefits from your salary income. Click the links IRS form 2441-Child and Dependent Care Expenses and form 2441-Instructions. The form 2441 is submitted to the IRS with your tax return, and list the one or more child and/or dependent care facilities you used. It lists your one or more children or disabled dependents who received the care, and the amounts spent on their behalf. It also lists the total amounts you paid these providers, and calculates your credit.

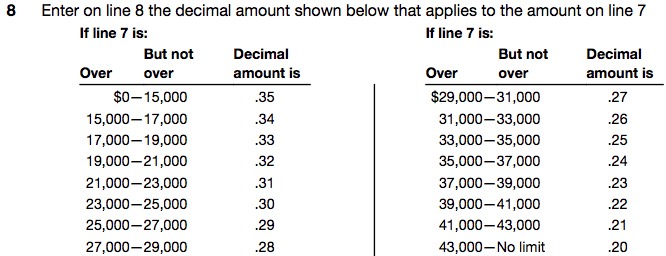

You can list up to $3,000 of qualified care expenses for each child or disabled dependent, and up to a total of $6,000 spent on two or more children or disabled dependents. Your credit of the expenses you incurred is then based on your line 22 Adjusted Gross Income (AGI), multiplied by a percentage associated with that AGI value, from the table shown below. The credit percentages range from 35% down to 20%.

This credit does not phase out based on income, so even taxpayers with their Adjusted Gross Income of over $43,000 can take the minimum credit of 20% of their child or dependent care expenses. For instance, if they could take advantage of the total $6,000 in expenses for two children, their 20% tax credit would still be $1,200 – which would reduce their tax liability by that $1,200 amount. This is one of the few tax credits that Congress did not impose an Income Cap upon.

As expected, all tax software will complete the calculations for you, and submit the properly completed form 2441 to the IRS on your behalf. The Credit for Child and Dependent Care Expenses is shown on line 31.

Credit for the Elderly or Disabled is a deduction for taxpayers over the age of 65, and for taxpayers who retired on permanent and total disability – and had taxable disability income. Schedule R is used to calculate the credit and prove to the IRS you passed the (2) main tests for the credit. See the links IRS form Schedule R and form Schedule R-Instructions.

The first test is the Income Limits for the credit. Your line 22 Adjusted Gross Income cannot be over the following amounts, for each of the filing status categories listed. If your income is above these limits, you cannot take the credit. You will notice the income levels are very low.

The second test is a limit on the amount of nontaxable payments you received from Social Security, and nontaxable pensions, annuities or disability income payments. These amounts are low also.

- Single, Head of Household, Qualifying Widow(er)

- Adjusted Gross Income of $17,500 or more disqualifies you

- You received $5,000 or more of nontaxable Social Security Benefits, or other nontaxable pensions, annuities or disability income. This will disqualify you for the credit.

- Married Filing Jointly (when only one spouse is eligible for the credit)

- Adjusted Gross Income of $20,000 or more disqualifies you

- You received $5,000 or more of nontaxable Social Security Benefits, or other nontaxable pensions, annuities or disability income. This will disqualify you for the credit.

- Married Filing Jointly (when both spouses are eligible for the credit)

- Adjusted Gross Income of $25,000 or more disqualifies you

- You received $7,500 or more of nontaxable Social Security Benefits, or other nontaxable pensions, annuities or disability income. This will disqualify you for the credit.

- Married Filing Separately (and you lived apart from your spouse all of the tax year)

- Adjusted Gross Income of $12,500 or more disqualifies you

- You received $3,750 or more of nontaxable Social Security Benefits, or other nontaxable pensions, annuities or disability income. This will disqualify you for the credit.

If your values are below the limits as described above, you will receive a 15% credit on the qualifying Social Security, pension or disability income you received. The tax software completes all the calculations for you, and submits the completed Schedule R with your tax return to the IRS.

This credit is seldom used, because the income levels are so low to qualify. The Credit for the Elderly or Disabled is shown on line 32.

The Education Credits are the American Opportunity Credit, and the Lifetime Learning Credit. These qualify you for a tax credit, based on the amounts of Tuition, Fees, Books and Supplies you spent during the tax year for an education at a qualified education facility. Undergraduate expenses are reported for the American Opportunity Credit for the first four years of college. Graduate work and adult learning courses are reported for the Lifetime Learning Credit, for the rest of your life. Form 8863 is used to calculate these credits. See the links IRS form 8863-Education Credits and form 8863-Education Credits-Instructions.

Your school or education facility will issue you a 1098-T Tuition Statement form each year electronically or by mail. This will show the total of Tuition and Fees you paid that tax year for your education. Click this link form 1098-T for the form.

You can also use expenses for Books, Labs and Fees not shown on the 1098-T form. It is good practice to save these other receipts, in case the IRS audits you to prove these expenses that qualified you for the Education Credits.

The American Opportunity Credit can reduce your tax liability by up to $1,500, and produce a refundable tax credit of up to $1,000. You only need $4,000 in qualified education expenses to qualify for the maximum credit. You can take this credit for yourself, and any other dependent you claim on your tax return, that also is a qualifying student. This is a “per eligible student” tax credit. This means you can claim up to the full $2,500 credit for yourself, and also for your dependent students. Each can reduce your tax liability by the $1,500, and give you a refundable credit of $1,000 per qualified student – for yourself and/or your dependent students listed on your tax return. Each person can use their own $4,000 of qualified education expenses to qualify for the credit. There are income limits, that begin to phase out the credit over certain income levels, shown below.

- Single, Head of Household, Qualifying Widow(er)

- When your Modified Adjusted Gross Income reaches:

- $80,000 – the credit begins to phaseout

- When your Modified Adjusted Gross Income is above:

- $90,000 – the credit is no longer allowed on your tax return

- When your Modified Adjusted Gross Income reaches:

- Married Filing Jointly

- When your Modified Adjusted Gross Income reaches:

- $160,000 – the credit begins to phaseout

- When your Modified Adjusted Gross Income is above:

- $180,000 – the credit is no longer allowed on your tax return

- When your Modified Adjusted Gross Income reaches:

- Married Filing Separately

- No American Opportunity Credit is allowed

The Lifetime Learning Credit can reduce your tax liability by up to $2,000. This is a “per return” credit, which means $2,000 is the maximum credit you can claim for yourself or dependent students. It is a 20% credit for up to $10,000 of combined qualified education expenses for yourself and your dependent students. No part of the credit is refundable, meaning the entire $2,000 credit can only be used to reduce your Tax Liability to zero, but not below zero. The Lifetime Learning Credit is for education expenses you or your dependent incurred, for Graduate School and Adult Learning classes. There is no age limit on this credit, as any qualified education classes you take, for the rest of your adult life, can qualify. Even if you only take one qualified night course, you qualify for this credit.

There are income limits, that begin to phase out the credit over certain income levels, shown below.

- Single, Head of Household, Qualifying Widow(er)

- When your Modified Adjusted Gross Income reaches:

- $55,000 – the credit begins to phaseout

- When your Modified Adjusted Gross Income is above:

- $65,000 – the credit is no longer allowed on your tax return

- When your Modified Adjusted Gross Income reaches:

- Married Filing Jointly

- When your Modified Adjusted Gross Income reaches:

- $111,000 – the credit begins to phaseout

- When your Modified Adjusted Gross Income is above:

- $131,000 – the credit is no longer allowed on your tax return

- When your Modified Adjusted Gross Income reaches:

- Married Filing Separately

- No Lifetime Learning Credit is allowed

Click this link Table to compare Education Credits to see a table comparing the features and benefits of each of these (2) Education credits.

All tax software will optimize for you, which of the (1) Education Adjustment or (2) Education Credits will give you the best tax benefit.

- Tuition and Fees Adjustment – 1040A page 1, line 19

- American Opportunity Credit – 1040A page 2

- line 33 (nonrefundable credit)

- Lifetime Learning Credit – 1040A page 2

- line 33 (nonrefundable credit) and

- line 44 (refundable credit)

The Retirement Savings Contribution Credit is a tax credit available to you if you made contributions to a retirement plan during the tax year. $2,000 of those retirement contributions are used for the credit, which ranges from 10%, 20%, or 50% of that $2,000 level of contributions. The amount of the credit is based on your filing status and Adjusted Gross Income level from line 22 of the form 1040A. See the table below:

The IRS form 8880 is used to calculate this tax credit. See the following link for the form and instructions IRS form 8880-Savers Credit.

The income limitations for each filing status are:

- Single, Qualifying Widow(er), Married Filing Separately

- if the Adjusted Gross Income is over $30,750 – the credit is not allowed

- Head of Household

- if the Adjusted Gross Income is over $46,125 – the credit is not allowed

- Married Filing Jointly

- if the Adjusted Gross Income is over $61,500 – the credit is not allowed.

You cannot take advantage of this credit, if any of the following apply:

- The person who made the retirement contribution is age 18 or under on December 31st of the tax year.

- The person who made the retirement contribution is claimed as a dependent on another taxpayer’s tax return

- The person who made the retirement contribution is a student

The tax software calculates the credit and submits the form 8880 with the tax return filed with the IRS. The Retirement Savings Contribution Credit is shown on line 34.

The Child Tax Credit is an up to $1,000 per child credit, for each Qualifying Child listed on your tax return as a dependent, and who also was under the age of 17 on December 31st of the tax year.

This $1,000 credit can be used to reduce your tax liability to zero, but not below zero. If all of the possible $1,000 Child Tax Credit is not used after your tax liability is reduced to zero – you might also qualify for the refundable Additional Child Tax Credit. This can refund the remaining amount of the initial Child Tax Credit – that was leftover after reducing your tax liability to zero. We will cover that in the next blog post that discusses the (4) refundable credits used on the form 1040A.

The IRS has (6) tests to make certain the Qualifying Child listed as a dependent on your tax return, also qualifies for the Child Tax Credit.

- Age: the child must be under the age of 17, on December 31st

- Relationship: they must be your Son, Daughter, Stepchild, Foster Child, Brother, Sister, Stepbrother, Stepsister – or a descendent of any of these, like a Grandchild, Niece, or Nephew. An Adopted Child also qualifies.

- Support: the child cannot provide over half of their support.

- Dependent: you must claim the child as a dependent on your tax return

- Citizenship: the child must be a U.S. Citizen, U.S. National, or U.S. Resident Alien with a Green Card, or per the substantial presence test.

- Residency: the child must have lived with you, for over half of the year. Temporary absences like school or hospital stays count.

The taxpayer, parents, and children can still qualify for this Child Tax Credit, if they only have ITIN’s (Individual Taxpayer Identification Numbers), not Social Security Numbers. See the IRS page for ITIN’s at IRS ITIN information.

They will not, though, qualify for the Earned Income Credit, as that credit requires that all people listed on the tax return must have valid Social Security Numbers that are eligible for work.

There are also income limitations above which the credit begins to phase out and eventually is reduced to zero credit.

- Single, Head of Household, Qualifying Widow(er)

- phaseout begins when Modified Adjusted Income is over $75,000

- credit not allowed when income is $95,000 or over

- Married Filing Jointly

- phaseout begins when Modified Adjusted Income is over $110,000

- credit not allowed when income is $130,000 or over

- Married Filing Separately

- phaseout begins when Modified Adjusted Income is over $55,000

- credit not allowed when income is $75,000 or over

For every $1,000 of income above these thresholds, the Child Tax Credit is reduced by $50. So once your income is $20,000 over the threshold, you will no longer qualify for any of the credit.

See this link Child Tax Credit Worksheet for the worksheet that calculates the Child Tax Credit. See this link IRS Publication 972-Child Tax Credit for the IRS Publication 972 that explains the Child Tax Credit in full. There are no IRS instructions for this credit, as that is all covered in the IRS Publication 972. The IRS often issues publications instead of instructions, for a more in-depth and specific explanation of tax matters.

The Child Tax Credit is shown on line 35.

Calculation to determine your final Total Tax liability value:

Line 36 of the form 1040A adds any of the (5) nonrefundable credits you qualified for to result in your Total Credits value. This value is then subtracted from your line 30 Initial Tax Liability value, to determine if you still have any tax liability – or the credits reduced that to zero. This appears on line 37, but cannot be below zero.

Line 38 adds any Health Care Individual Responsibility penalty tax if you did not have health insurance coverage for the entire year. This was discussed in the blog posts about the form 1040EZ. See that blog post at The 1040EZ: Payments, Credits and Tax and scroll down for the explanation of this penalty tax, at the line 11 explanation.

Your Total Tax liability shown on line 39 of the form 1040A is then calculated – as it adds the line 37 and 38 values.

Click the link below for the next blog post that explains the Payments and (4) Refundable Credits on the form 1040A. This will be the last blog post in the series for the form 1040A – that will then determine if you get a refund or you owe tax.

The 1040A: Payments and (4) Refundable Credits

Feel free to comment on these blog posts, or send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2017 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2017 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.