Payments and the (4) Refundable Credits are the last topics we need to discuss, to complete the 1040A form to the point you can determine if you get a refund, or if you owe a tax payment to the IRS.

As you recall from the previous blog post, your Total Tax liability is calculated on line 39 of the form 1040A. You can then offset this with any tax Payments you made during the year, and the positive refund values from any of the (4) Refundable Credits you might qualify for. If your Payments and Refundable Credits add up to be more than your Total Tax liability – you will get a refund. If your Total Tax liability is more than your Payments and Refundable Credits, you will owe a tax payment.

Payments shown on the form 1040A come from four possible sources:

- Taxes withheld from your paycheck, as shown on your W-2 form

- Taxes withheld from other income sources, shown on a 1099-form

- from Bank and Brokerage account income

- from IRA, Pension, Annuity and Social Security income

- from Unemployment Benefits income

- Taxes you paid quarterly to the IRS, as Estimated Payments

- Amount of your 2015 IRS tax refund, applied to 2016 tax payments

If you have a salary job, your company withholds Federal, Social Security, Medicare, State and Local taxes from each of your paychecks. They forward these to the IRS and the States, on your behalf, to be recorded in your tax accounts with the IRS and the States. This fulfills your obligation to pay your taxes as you earn the money – the “Pay As You Go” rule. This total Federal salary tax withholding value goes on line 40 of the form 1040A. The software calculates this from your W-2 entries.

If you instructed other payers of your income sources during the year to withhold IRS or State taxes – those appear on the 1099 forms, such as:

- 1099-INT that reports the Interest you earned

- 1099-DIV that reports the Dividends you earned

- this 1099-DIV form could also show Capital Gain Distributions

- 1099-Consolidated that reports Capital Gain Distributions and other brokerage income you earned from mutual funds, stock sales, etc.

- 1099-G that reports Unemployment Benefits you received from your State

- 1099-R that reports IRA, Pension and Annuity income you received

- SSA-1099 that reports Social Security Benefits you received

The tax withholding values from any of these 1099 forms go on line 40 of the form 1040A. The software calculates this from your 1099 entries.

Some taxpayers prefer to just pay the IRS and the States directly on a quarterly basis, to cover their expected tax obligation from their various income sources. These are called Estimated Payments, and are mailed to the IRS and the States quarterly on April 15th, June 15th, September 15th and January 15th of each tax year. Estimated Payments can also be made electronically through the IRS and State’s websites. These have to be manually entered into the tax software, sorted by the quarterly payment dates and amounts sent for each quarterly payment. These are recorded on line 41 of the form 1040A.

Each year you can also instruct the IRS and/or the States to forward all or part of your tax refund – to be credited to your next year’s Estimated Payments total. Many taxpayers who regularly make quarterly Estimated Payments use this refund forwarding method. These are also recorded on line 41 of the form 1040A.

The (4) Refundable Credits can reduce your Total Tax liability to zero and then create a refund for you, with any remaining refundable credits they generate for you, after reducing your Total Tax liability to zero. They are:

- The Earned Income Credit (EIC) on line 42a

- The Additional Child Tax Credit on line 43

- The American Opportunity Credit on line 44

- The Net Premium Tax Credit on line 45

The Earned Income Credit (EIC) was discussed in (2) previous blog posts, as indicated by the two blue hyperlinks below. If you have not reviewed these two posts previously, please do so now, as they give a good introduction to the Earned Income Credit. Just scroll down into each post until you reach the discussion of the Earned Income Credit in the posts.

The 1040EZ: Payments, Credits and Tax

The 1040A: Who Can Use this Form?

Refer to Publication 596-Earned Income Credit (EIC) for the IRS publication that explains in detail the requirements and rules to qualify for the Earned Income Credit.

The Earned Income Credit requires that all people listed on the tax return must have valid Social Security Numbers that are eligible for work. This includes the taxpayer, parents, and any children listed on the tax return.

The main enhancement to the Earned Income Credit (EIC) on the form 1040A is you can qualify for more of the credit, based upon you having up to three Qualified Children listed as Dependents on your form 1040A. The maximum levels of the Earned Income Credit (EIC) you can receive are:

- $506 if you have no Qualifying Children

- $3,373 if you have (1) Qualifying Child listed as a Dependent

- $5,572 if you have (2) Qualifying Children listed as a Dependent

- $6,269 if you have (3) Qualifying Children listed as a Dependent

For each of the EIC Credit levels there is an ideal income level which gives you the maximum credit, based on your filing status. See those ideal income levels in the lists below, based on your Filing Status.

- Single, Head of Household, Qualifying Widow(er) filing status

- $506 credit with no Qualifying Child: between $6,600 and $8,300

- $3,373 credit w/ (1) Qualifying Child: between $9,900 and $18,200

- $5,572 credit w/ (2) Qualifying Children: between $13,900 and $18,200

- $6,269 credit w/(3) Qualifying Children: between $13,900 and $18,200

- Married Filing Jointly filing status

- $506 credit with no Qualifying Child: between $6,600 and $13,850

- $3,373 credit w/ (1) Qualifying Child: between $9,900 and $23,750

- $5,572 credit w/ (2) Qualifying Children: between $13,900 and $23,750

- $6,269 credit w/ (3) Qualifying Children: between $13,900 and $23,750

- Married Filing Separately filing status

- The Earned Income Credit is not allowed for Married Filing Separately

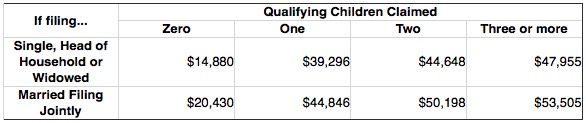

Above a certain income level, you cannot take the Earned Income Credit, based on your Filing Status and the number of Qualifying Children you list as Dependents on your tax return. Refer to the below table.

If you claim Qualified Children for your Earned Income Credit, you have to also submit the Schedule EIC which lists their information:

- the Child’s name

- the Child’s social security number

- the Child’s year of birth

- the Child’s status as a student and/or their disability status

- the Child’s relationship to you

- the number of months the Child lived with you during the current tax year

Click this hyperlink to see the Schedule EIC.

The Earned Income Credit has a massive amount of fraud, as some taxpayers list false income numbers, and claim children who are not their actual children. All paid tax preparers have to complete a Due Diligence checklist that is submitted to the IRS with your tax return. The paid tax preparer has the responsibility to verify that all Earned Income Claims are legitimate – or they are fined $550 per fraudulent EIC tax return. Click this link to see how extensive the questions are on this form, we as paid tax preparers have to complete Paid Preparer’s Due Diligence Checklist.

The Earned Income Credit is reported on line 42a of the form 1040A.

The Additional Child Tax Credit is the refundable portion of the line 35 $1,000 Child Tax Credit that was leftover after your line 37 Tax liability was reduced to zero. You could qualify for this $1,000 Child Tax Credit for each Qualified Child under the age of 17, listed as a dependent on your tax return. See this blog post The 1040A: the (5) Non-Refundable Tax Credits for the Child Tax Credit explanation.

You calculate the Additional Tax Credit on the IRS form 8812-Additional Child Tax Credit. For instance, maybe only $600 of the $1,000 Child Tax Credit was used to reduce your line 37 Tax liability to zero. That leaves $400 of credit still unused. You then could receive that extra $400 as a refundable refund credit – if you qualify for the Additional Child Tax Credit. The same income limitations apply for this Additional Child Tax Credit – as could limit your original Child Tax Credit. See the form 8812-Additional Child Tax Credit-Instructions.

The point to remember is for each Qualifying Child under the age of 17 listed on your tax return as a Dependent, you could qualify for this up to $1,000 per Child Tax Credit / Additional Child Tax Credit combination.

The taxpayer, parents, and children can still qualify for this Additional Child Tax Credit, if they only have ITIN’s (Individual Taxpayer Identification Numbers), not Social Security Numbers. See the IRS page for ITIN’s at IRS ITIN information.

They will not, though, qualify for the Earned Income Credit, as that credit requires that all people listed on the tax return must have valid Social Security Numbers that are eligible for work.

The Additional Child Tax Credit is reported on line 43 of the form 1040A.

The American Opportunity Credit (AOC) is the $1,000 refundable portion of the total $2,500 AOC credit you could qualify for as a deduction related to your Undergraduate education expenses. See this blog post The 1040A: the (5) Non-Refundable Tax Credits for the entire explanation of the American Opportunity education credit. The first $1,500 of the credit can be used to reduce your Total Tax liability to zero. The remaining $1,000 of the AOC credit can be refunded to you, even if your Total Tax liability has been reduced to zero.

The refundable, up to $1,000 American Opportunity Credit, is reported on line 44 of the form 1040A.

The Net Premium Tax Credit is a refund of the final Premium Tax Credit you qualified for, after taking into account your final income total, and if you received any of the Advance Premium Tax Credits towards your monthly health insurance premiums. This was explained in this blog post The 1040A: Affordable Care Act issues as part of the larger discussion of The Affordable Care Act and how it can affect your tax return each year.

The Net Premium Tax Credit is reported on line 45 of the form 1040A.

Line 46 on the form 1040A adds up the following Payments and Credits:

- line 40: Federal Income Tax withheld from your W-2’s and 1099’s

- line 41: 2016 Estimated Tax Payments and amount of 2015 refund applied

- line 42a: Earned Income Credit

- line 43: Additional Child Tax Credit

- line 44: American Opportunity Credit

- line 45: Net Premium Tax Credit

You will receive a refund if these line 46 Total Payments, are larger than your line 39 Total Tax liability. The refund is shown on line 47. You can have your refund directly deposited into your checking or savings account, or have the IRS mail you a refund check. You can also split the refund between several accounts using the form 8888 Allocation of Refund. For instance, some can go into your IRA account, some into Savings, and the rest into Checking. You can also use this form 8888 to instruct the IRS to purchase U.S. Savings Bonds with your refund. Line 49 lets you instruct the IRS how much of your refund, you would like to be credited to your next year’s Estimated Tax payment totals.

You will owe a tax payment, if your line 39 Total Tax liability is more than your line 46 Total Payments. The tax owed is shown on line 50. You can instruct the IRS to directly debit the tax owed from your checking or savings account, or you can mail them a check with a payment voucher. Line 51 calculates any Estimated Tax Penalty you owe, if your taxes owed are more than $1,000. This is included in the total line 50 tax owed value. The software automatically calculates this penalty for you.

Congratulations! You have completed the (11) blog post lessons that explained the form 1040A. Click the hyperlink below to begin the blog posts that will explain the form 1040 – the most complicated tax form.

The 1040: Who Can Use this Form?

Feel free to comment on these blog posts, or send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2017 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2017 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.

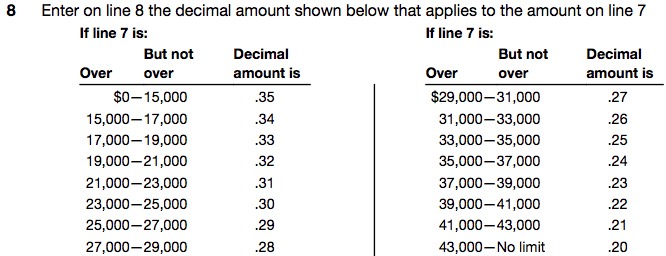

See the example from the Tax Tables at the left, for a Single taxpayer, who has a Taxable Income of $75,535. Their Income Tax Liability would be $14,653. Their Taxable Income is between $75,500 and $75,550 in the table.

See the example from the Tax Tables at the left, for a Single taxpayer, who has a Taxable Income of $75,535. Their Income Tax Liability would be $14,653. Their Taxable Income is between $75,500 and $75,550 in the table.