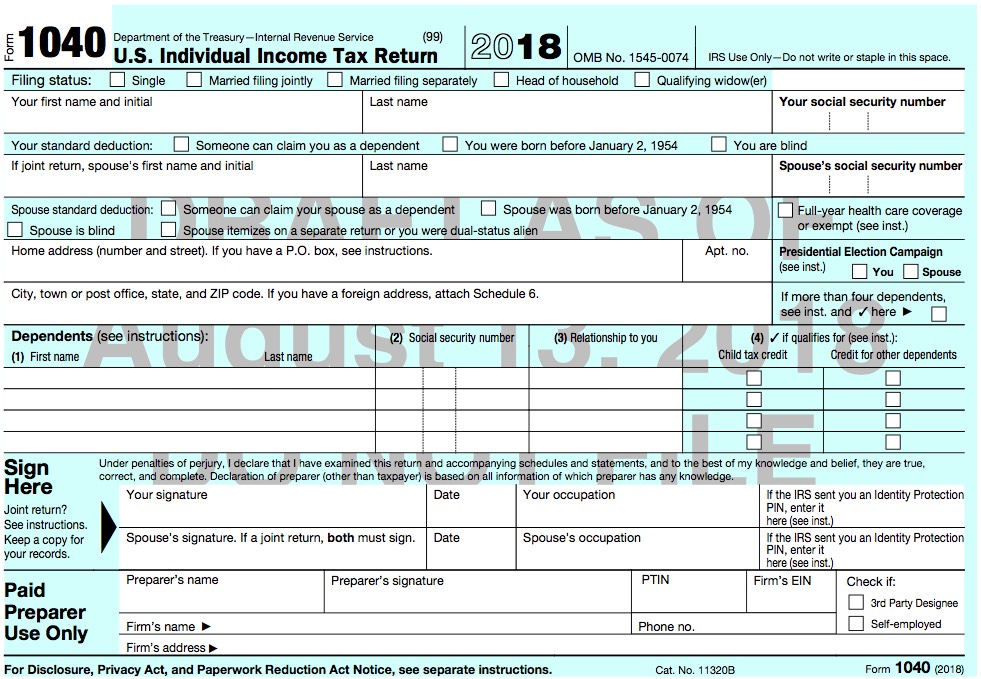

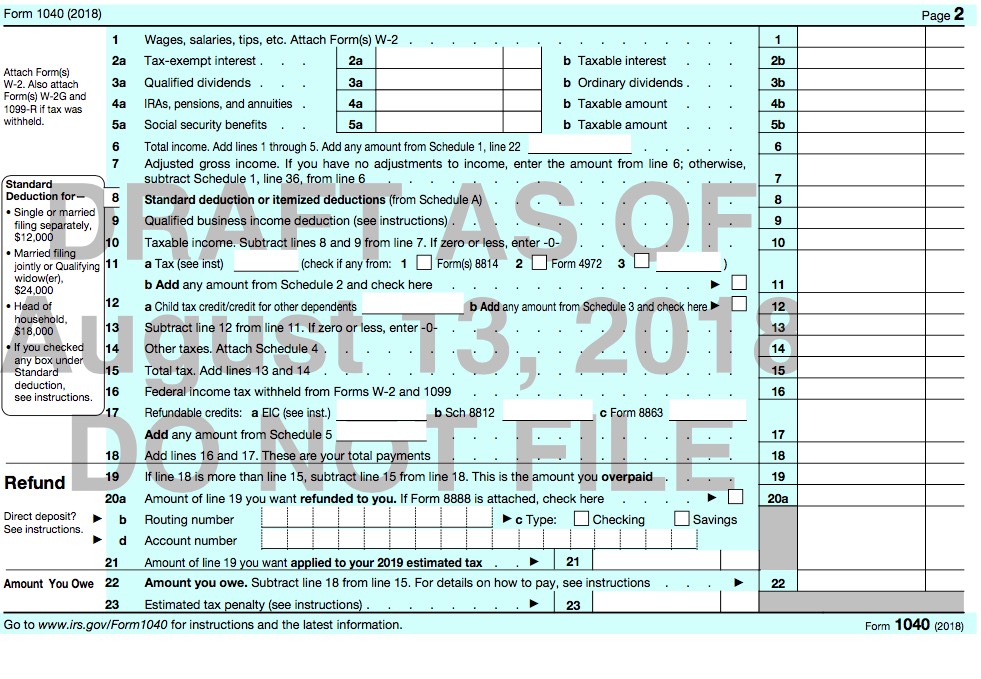

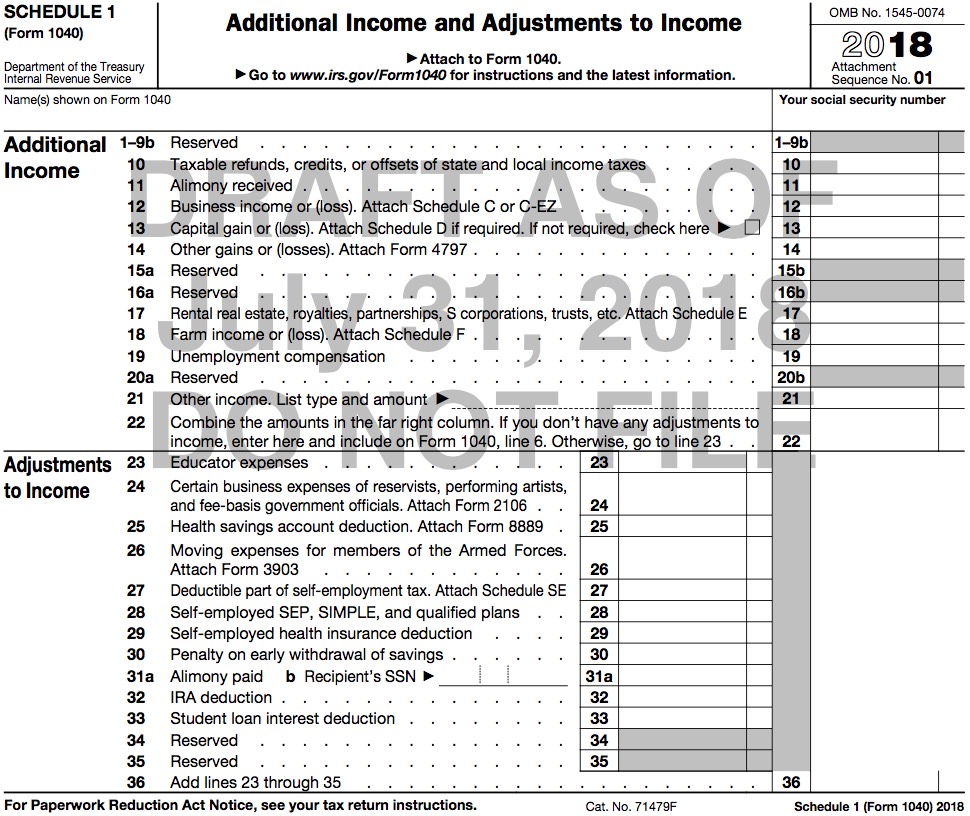

This Blog will explain the (5) Filing Status choices that are available to Taxpayers for the 2018 Tax Year. Filing Status is indicated on the Top Half of the new “1040 Simplified” tax form.

Filing Status tells the IRS what category of taxpayer you are – as defined by your marital status on December 31st of each tax year. Filing Status can also be affected by your household situation – if you support children, relatives or friends living in your home.

Each tax year, you have to tell the IRS on your tax form if you are considered Single, Married Filing Jointly, Married Filing Separately, a recent Widow(er) supporting your children, or a Single person supporting and providing a household for children, relatives or friends. The (5) Filing Status categories accommodate these scenarios.

Filing Status is important because the Standard Deduction, the Tax Rate Tables and many Adjustments, Deductions and Credits are based on your Filing Status. You might qualify for more than one Filing Status, so you would choose the one that gives you the best tax benefits. For example, some people can file as Single or Head of Household. Head of Household usually gives the taxpayer a more favorable tax treatment than Single.

This link for the 2017 Tax Year Publication 501-Exemptions, Standard Deduction & Filing Information gives the IRS definitions and explanations for:

- Filing Status

- Filing Requirements

- Definitions of Dependents

- Personal and Dependent Exemptions (Obsolete for the 2018 Tax Year)

- Standard Deduction

It is a terrific resource for the IRS explanations for Filing Status. I will update the link, when the IRS releases the 2018 version of the publication.

Single is the first filing status you consider. It means that you were not legally married on December 31st of the tax year. If you are the only person listed on the new “1040 Simplified” form, and you do not list Children or Dependents, the IRS assumes your filing status is Single. There is no checkbox on the form for Single.

The scenarios that define you as Single are:

- You were never married in that tax year.

- You were legally separated or divorced by December 31st of the tax year.

- You were recently widowed and did not remarry in the tax year immediately following the year your spouse died.

- Typically you would have the filing status of Married Filing Jointly or Separately, in the year your spouse dies. It is the following year you could be considered Single.

- You did not support your own children or relatives in your household.

- You could have supported one or more non-relatives in your household, and still use the Single filing status. See that explanation below:

If a non-relative lived with you the entire year, and you provided for their financial support, they could qualify as an Other Dependent. You would still use the Single filing status, as these non-relative Dependents would not qualify you for the Head of Household filing status.

For example, you could claim your Girlfriend and her child, as non-relative Dependents on your Single tax return, if they lived with you the entire year, and you provided for their financial support. Neither of them could have income above a certain threshold defined by the IRS each year.

Married Filing Jointly (even if only one had income) is the filing status where you and your spouse combine both of your Incomes and Deductions onto one tax return. You also are both equally liable for any tax due on the jointly filed return. You can also lists dependent Children or Other Dependents on your tax return, with this filing status.

If you as the Taxpayer, and your Spouse, are the only persons listed in the header of the new “1040 Simplified” form, the IRS assumes your filing status is Married Filing Jointly. There is no checkbox on the form for Married Filing Jointly.

The scenarios that define you as Married Filing Jointly are:

- You were married as of December 31st of the tax year, and lived together the entire tax year. Both of you had income to report.

- You were married and lived together the entire year, and only one spouse had income to report.

- You were newly married in the current tax year, and remained married as of December 31st. You have to file as a Married couple, even though you weren’t married the entire year. Your status on Dec. 31st is what counts.

- You were married as of December 31st of the tax year, even if you didn’t live with your spouse on December 31st. You both still can choose to file jointly and report your combined Income and Deductions to the IRS.

- Your spouse died in the tax year, and you did not remarry in the tax year.

- You were married as of December 31st, but your spouse died early in the following year before the April 15th tax filing deadline. You still file as Married Filing Jointly or Separately, as that was your marital status on December 31st, of the year prior to the death of your spouse.

- You will also file as Married Filing Jointly or Separately, in the year your spouse died, as explained earlier. So long as you did not remarry in the year your spouse died.

Married Filing Separately is the filing status where you and your spouse report your Income and Deductions separately on two distinct and separate tax returns. This is essentially each married spouse filing as a Single person, except you are not allowed to use the Single filing status – if you were legally married on December 31st of the tax year. A married couple can only file Jointly or Separately, except under special circumstances when children are involved, and the spouses have not lived together the last six months of the year. In that case, one spouse could possibly qualify to use the Head of Household filing status, and claim the children as dependents on their tax return.

Married Filing Separately is most often the least advantageous filing status, because many Adjustments, Credits and Deductions are not allowed when you use this filing status. Congress wrote these restrictions into the Tax Laws, as they frequently write tax law to be more advantageous to a Married couple, in this case to a Married Filing Jointly couple.

You would check the box that says “Married filing separate return” and you list your spouse’s social security number on your tax return.

Qualifying Widow(er) (with dependent child) is the filing status to use when your spouse died the year before the current tax year, and you still are supporting your young children. You can qualify to use this Filing Status for the two tax years after the year your spouse died. It gives you the best tax treatment, as it uses many of the values for the Married Filing Jointly filing status. It is more advantageous than using the Head of Household filing status.

For example, your spouse died in 2017 and you are still raising two young Children. For the 2017 tax year your spouse died, you would still use the Married Filing Jointly filing status. For the tax years 2018 and 2019, you would use the Qualifying Widow(er) filing status. Then for the tax year 2020 and beyond, you would use the Head of Household filing status. It is designed to give you an extra financial buffer, for those first two years after your spouse died, and you remained unmarried supporting your children.

You would check the box that says “Qualifying widow(er)” and you would list your children as dependents on your tax return.

Head of Household (with qualifying person) is the filing status where you are considered “Unmarried”, and you also financially support one or more Dependents in your household. You could be supporting a child or relative as they live in your household – and you provide for their living expenses. These Dependents are either Qualifying Children and/or Other Qualifying Relatives. They must be related to you, as defined by the IRS rules. The next blog post defines Dependents.

The (3) tests you must meet to use the Head of Household filing status are:

- You are unmarried, or considered unmarried, on the last day of the tax year, on December 31st.

- You paid more than half of the cost of keeping up your home for the tax year. The IRS provides a worksheet to calculate this.

- A qualifying person, that you list as a Dependent on your tax return, lived with you for more than half of the tax year, including temporary absences like a child at college. A dependent parent does not have to live with you.

In some circumstances the Dependent does not have to live in your household, and you can still qualify to use the Head of Household filing status. For example, your parent can be living in a nursing home, but you still provide the majority of their support, or their living expenses. You could claim them as a Qualifying Relative – which would allow you to use the more advantageous Head of Household filing status, versus for example the Single filing status. The parent would just have to meet all (4) of the IRS tests, to still qualify as your Qualifying Relative. For example, their taxable income could not exceed the Gross Income Limit amount each year. This is called the Gross Income test. There are (3) other IRS tests they must meet.

See page 19 of the Publication 501-Exemptions, Standard Deduction & Filing Information for the list of “Relatives who don’t have to live with you in your household the entire year” – to still qualify you to use the Head of Household filing status. They do, though, have to live with you for over 6-months in the year. These are considered Qualifying Persons, as they are related to you, as specified in this list on page 19.

A friend who is not a relative as defined above, would not be a Qualifying Person, even if they lived with you the entire year. For example a girlfriend or boyfriend, and possibly their children. If these people lived with you the entire year, and you financially supported them, you would qualify to use the Single filing status and could list them as Dependents. You cannot, though, use them as Qualifying Persons for the Head of Household filing status. They must be related to you, as defined on page 19 of Pub. 501.

A spouse of a married couple could be considered “Unmarried”, if the couple did not live together the last six months of the year. That “Unmarried” spouse could then possibly list Qualifying Children as Dependents on their tax return, and qualify to use the Head of Household filing status, instead of the less advantageous Married Filing Separately filing status. The children would just have to meet all of the (5) IRS tests that would define them properly as Qualifying Children.

This is by far the most complicated, and abused, Filing Status category. Many taxpayers try to qualify for the Head of Household filing status, only to have the IRS disallow it after they are audited. Competent tax preparers will help you with this, to make certain you meet all the requirements.

Starting with the 2018 tax year, the IRS will fine tax preparers $505 per occurrence, if they don’t use proper due diligence in qualifying their Clients for the Head of Household filing status. Therefore your tax professional will ask for proof, that the dependents are your relatives, and you met all the other requirements of the Head of Household filing status. Tax preparers must fill out form 8867 to prove their due diligence Form 8867 Preparer Due Diligence . This is the 2017 version, that already makes tax preparers prove due diligence for the Earned Income Credit, the Child Tax Credit/Additional Child Tax Credit, and the American Opportunity Education Credit. I will update to the 2018 version when available.

You would check the box that says “Head of household” and you would list your qualifying children or relatives as dependents on your tax return.

Click the link below for the next Blog post to learn about which Dependents you can list on your tax return.

2018 Tax Year (Dependents)

Feel free to send me an email at Mike@TaxesAreEasy.com

Blog Written Content ©2018 Michael D Meyer. All rights reserved.

PDF IRS forms, instructions & publications – ©2018 Department of the Treasury Internal Revenue Service IRS.gov

Legal Disclaimer: Nothing written or expressed in this Blog shall be construed as legal, accounting, or tax advice. This Blog is for informational purposes only, to inform Individuals about the IRS tax forms required to file an individual tax return, and the instructions that accompany such IRS tax forms.

This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any tax transaction or filing any tax form.